Yesterday, Bernanke staged a “conference” answering “questions” from “journalists.” It’s striking that the man with the most power in the world would be handled with kid gloves. After all, if he’s in charge of directing the world’s reserve currency, surely he could answer a few hardball questions about his insane policies.

However, instead of holding this miscreant accountable for his monetary madness, the “journalists” let him prattle on with his meaningless drivel.

The markets, on the other hand, read through his BS. Soon after the conference the US Dollar collapsed to a three year low.

At this point, there is only one line of support left for the US Dollar. That’s one line, standing between us and the abyss of all-time lows: a point at which there is no support left.

At this point, there is only one line of support left for the US Dollar. That’s one line, standing between us and the abyss of all-time lows: a point at which there is no support left.

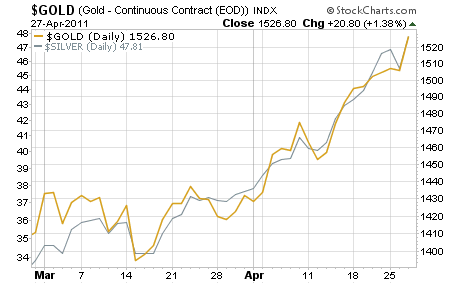

Gold and Silver also bounced back after having been slammed by various suppression schemes last week. All those, “the rally is over,” folks got shanked in the ribs as Gold hit a new all-time high and Silver retraced almost all of its former losses in a few hours.

In other words, the great inflationary collapse of the US Dollar is in full effect. Again, there is only one line of support left for the greenback. If Bernanke was going to do ANYTHING to support the Dollar, yesterday was the day for him to have done it. Instead, we’re going to enter a mega-inflationary collapse.

In other words, the great inflationary collapse of the US Dollar is in full effect. Again, there is only one line of support left for the greenback. If Bernanke was going to do ANYTHING to support the Dollar, yesterday was the day for him to have done it. Instead, we’re going to enter a mega-inflationary collapse.

Indeed, at the current pace we’re going the US Dollar will be collapsing within one month. This could change, but we’d need another 2008 type event to pull the US Dollar back from the brink. And judging from stocks and inflation hedges’ performance today, that ain’t happening.

So if you are not already preparing for mega-inflation, you need to get moving now. Because time is running out.

Indeed, this is why since March 2010, I’ve been shifting subscribers of my Private Wealth Advisory into extraordinary inflation hedges: investments that will outperform even Gold and Silver in the coming inflationary disaster.

To whit, since March 2010, our inflation portfolio is up 29% vs. the S&P 500’s performance of 14%. We’re currently sitting on gains of 17%, 34%, 35% and a whopping 176%.

To find out about my inflation portfolio… including the nine extraordinary investments in it… all you need to do is take out a “trial” subscription to Private Wealth Advisory.

You’ll then immediately be given access to the Private Wealth Advisory archives where you can find out the names, symbols, and how to buy all nine of these incredible inflation hedges.

You then have 30 days to decide if Private Wealth Advisory is for you. If at any point during those 30 days you decide it’s not, just drop me an email and I’ll issue a full refund NO QUESTIONS ASKED.

To take out a “trial” subscription to Private Wealth Advisory…

Good Investing!

Graham Summers