The market rally that began on Friday and continues today is largely based on end of the month performance gaming. Normal market action doesn’t involve every asset under the sun rallying together. And given that the Fed didn’t announce QE 3 (and despite many claims to the contrary, didn’t telegraph it either), there was no reason for stocks to explode higher on Friday.

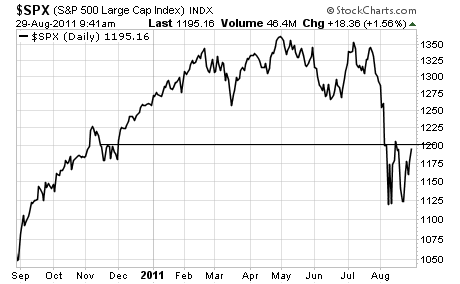

Regardless of the reasons for the move, stocks are now coming up against resistance at 1,200 on the S&P 500:

What happens here will go a long ways towards explaining what’s to come. It’s worth noting that the credit markets have shown no indication of bullishness (nor of QE 3 coming for that matter).

Similarly, Gold has the makings of a Head and Shoulders top:

This pattern, if confirmed, will see Gold at $1,600 in short order. Given how overstretched the precious metal had become, this is quite possible.

On a final note, the Euro could be in the final stages of intervention/ bailouts. On September 8, a German court will be ruling whether it is constitutional for Germany to participate in EU bailouts. Consider that 6% of Germans feel the Euro has brought economic disadvantages and that the German elections are scheduled for just a few weeks later, and we could very well see the court rule to end Germany’s participation in the bailouts.

Which would mean Game. Set. Match. for the Euro and the EU in its current form. Indeed, judging from the credit markets and the ongoing liquidity Crisis in Europe,

I fully believe we could see another catastrophic Crash similar to 2008 in the coming months.

The similarities between this environment and 2008 are striking. We have a major bank on the brink of collapse (Bank of America). The credit markets are in major disarray. Liquidity is drying up. And so on.

Many people are going to see their portfolios get completely destroyed.

But you don’t have to be one of them.

Indeed, I can show you how to turn this period into a time of profits, NOT pain. To whit, my clients actually made money in 2008, having been warned a full three weeks in advance of the Crash to get out the market and go short.

I believe we could see another 2008 situation unfold in the near future, which is why I just unveiled six specific trades to subscribers… all of which will pay off HUGE returns as the current stock market collapse accelerates.

We’ve also taken steps to prepare ourselves sand our loved ones for what’s coming to the US economy (bank holidays, food shortages, stock Crashes, debt defaults, civil unrest and more) with my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports: 40+ pages of material devoted to showing individual investors how to prepare these areas of their lives in great detail.

So we’re ready for whatever may come. And the worse things get… the more profitable our strategy will be.

If you’ve yet to take these steps yourself, it’s not too late… in fact, you’ve still got time to get your financial “house” in order to not only survive what’s coming… but potentially even make serious money from it.

All you need to do is take out a “trial” subscription to my Private Wealth Advisory newsletter. You’ll immediately be given access to the Private Wealth Advisory archives. You’ll also receive copies of the reports I detail above… and you’ll also be on my private client list to receive my bi-weekly investment reports as well as real-time trade updates on when to buy and sell various investments.

And if you should decide that Private Wealth Advisory is not for you, you can ask for a full refund during the first 30 days and I’ll return every cent of your subscription cost.

The reports you’ve downloaded during your “trial” period are yours to keep, even if you choose to cancel.

To get started with you Private Wealth Advisory subscription today, download the Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports and start taking action to prepare for what’s coming…

Good Investing!

Graham Summers

Editor In Chief

Gains Pains & Capital