Every day that Germany continues to flirt with the idea of propping up Europe, is another day that the country gets closer to its own fiscal crisis.

The mainstream media believes that Germany is somehow the bastion of fiscal strength. However, even a cursory look at the facts disproves this.

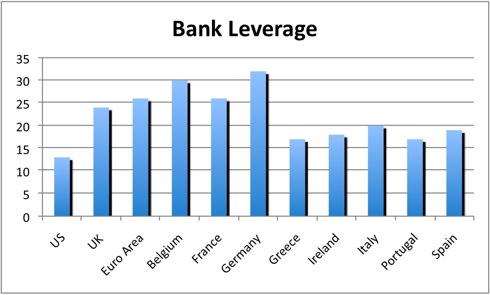

For starters, German banks post some of the highest leverage rations in Europe: higher that Italy, higher than Ireland, even higher than Greece. In fact, German banks are actually sporting leverage EQUAL to that of Lehman Brothers when it went bust.

To make matters worse, Germany has yet to recapitalize its banks. Indeed, by the German Institute for Economic Research’s OWN admission, German banks need 147 billion Euros’ worth of new capital.

Mind you, this is just NEW capital demands. In addition to this, German banks need to roll over 40% of their total outstanding debt within the next 12 months.

This is at a time when the many European nations are relying on the ECB to insure they don’t have a failed bond auction (by the way Germany had a failed bond auction just a few weeks ago).

Suffice to say, the German banking system isn’t as rock solid as the mainstream consensus. The German government knows about this situation which is why it’s already preparing for the potential nationalization of Germany’s largest banks should things get messy.

Germany’s sovereign balance sheet isn’t a whole lot better either. Officially, Germany has a Debt to GDP ratio of 84%. However, according to Axel Weber, the most recent head of Germany’s Central Bank (he left April 2011), Germany is in fact sitting on a REAL Debt to GDP ratio of over 200%. This is Germany… with unfunded liabilities equal to over TWO times its current GDP.

What’s truly frightening about this is that Weber is most likely being conservative here. Jagadeesh Gokhale of the Cato Institute published a paper for EuroStat in 2009 claiming Germany’s unfunded liabilities were in fact closer to 418% (and that was two years ago).

This further goes with my primary view: Germany has its own problems to deal with. So the idea that Germany is somehow going to prop up the EU is not really realistic. After all, if Germany was indeed going to serve as the mega-European backstop, don’t you think it would already have done so?

The truth is this: the German constitution won’t permit the issuance of Euro bonds. And the German population/ social contract between German politicians and voters will not stand for money printing of any kind.

So… don’t bank on Germany coming to save the day. Indeed, even the option of Germany somehow taking over other EU nations budgetary controls is ridiculous as NO EU member would submit to that.

Instead, I expect Germany to duck out of the Euro in the near future. It may happen in the next few weeks or it may happen in early 2012. But considering that the Federal Reserve had to step in to save the European banking system today I believe it will be sooner rather than later.

So if you believe that Germany is going to save the EU… you’re in for a rude surprise. Indeed, if we look at the bond or credit markets, it’s clear we’re into a Crisis far greater than 2008. Forget the stock market rally. Stocks ALWAYS get it last (just like in 2008). And before the smoke clears on this mess we’re going to see sovereign defaults, bank holidays, riots, and more.

Many people will lose everything in this mess. Yes, everything. However, you don’t have to be one of them. Indeed, I can show you how to turn this time of collapse into a time of profits.

Few people on the planet can match my ability to return a profit during times of Crisis.

To wit, my clients MADE money in 2008 outperforming every mutual fund on the planet as well as 99% of investment legends.

We also outperformed the market by 15% during the Euro Crisis of 2010. And since the latest round of the Euro Crisis began in July 2011, we’ve locked in not 10, not 20, but 32 STRAIGHT WINNERS including gains of 12%, 14%, 16% and 18%,

So if you’re looking for a guide to get you through the coming disaster, I’m your man.

I’ve been helping investors, including executives at many of the Fortune 500 companies, navigate their personal portfolios through the markets for years.

I can do the same for you with m y Private Wealth Advisory newsletter.

The minute you subscribe to Private Wealth Advisory you’ll be given access to my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports telling you precisely which steps to take to prepare your loved ones and your personal finances for what’s coming.

You’ll also join my private client list in receiving my bi-weekly market updates outlining what’s really happening behind the scenes in the markets and which investments will profit in the coming months.

And when it’s time to pull the trigger on a given investment, I’ll send you real-time trade alerts.

All of this is yours for just $249 per year.

The time for dilly dallying is over. Europe is literally on the eve of systemic failure. Even the IMF has warned we’re facing a global collapse.

To take action to protect yourself… and insure that the coming weeks and months are a time of profit and safety, NOT losses and pain…

Best Regards

Graham Summers