The market is rallying… again… on hopes of a Greek deal… and QE 3.

This is the very same game we’ve been playing for over two years now. Greece is broke. Everyone knows it. The Greeks know it. Greek politicians know it. EU politicians know it. Even the IMF knows it. The only people who don’t seem to “get it” are stock investors that invest for one reason only:

1) The hope of more juice/ intervention from Governments/ Central Banks

That one sentence dictates ALL market action today: the hope of a stupid policy (spending more money), which has failed to solve anything. It’s amazing that this is what the markets have become. What’s even more amazing is that people are actually paid (large salaries) to engage in this stupid behavior.

Honestly, how many times have we heard rumors that Greece was solved? How many “officials” claimed a deal was close? How many investors bought based on these outright lies?

Moreover, it’s not as though the actual proposals that do get announced are worth the paper they’re written on. A 50% haircut on private bondholders of Greek debt accomplishes nothing (Greece’s Debt to GDP would still be north of 120%). The only way Greece gets back to some semblance of solvency is a complete and total wipe out of all debt other than that held by the Troika (though they should take a hit as well).

This whole mess will end terribly. Greece will default. The default will be bigger than 50% (likely 70-80%). Italy, Spain, and other EU members will default as well. This will happen. There is no question about it.

However, right this week, the market is waiting for more juice from the Fed’s Jan 25 FOMC and the hope of a Greek deal out of Europe. For that reason stocks have gone almost straight up for the last two weeks.

By the look of things we’ve got a messy bearish rising wedge here. We’re now testing resistance in the form of the upper trendline.

By the look of things we’ve got a messy bearish rising wedge here. We’re now testing resistance in the form of the upper trendline.

What’s truly interesting here is that the Emerging Market space has been lagging US stocks in a big way on this move: a marked difference from the market action that preceded QE lite and QE 2.

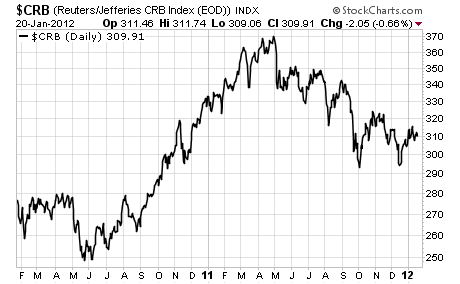

The same goes for commodities and other “Risk On” assets, which are not even close to exceeding recent highs:

The same goes for commodities and other “Risk On” assets, which are not even close to exceeding recent highs:

So… are stock investors smarter than everyone else… or are they just gunning the market on low volume yet again regardless of reality? We’ll find out this week once we get past the Fed FOMC and Europe’s decision on Greece.

If you’re looking for actionable advice on how to play the markets I suggest checking out my Private Wealth Advisory newsletter.

Private Wealth Advisory is my bi-weekly investment advisory published to my private clients. In it I outline what’s going on “behind the scenes” in the markets as well as which investments are aimed to perform best in the future.

My research has been featured in RollingStone, The New York Post, CNN Money, the Glenn Beck Show, and more. And my clients include analysts and strategists at many of the largest financial firms in the world.

To learn more about Private Wealth Advisory and how it can help you navigate the markets successfully…

Graham Summers

Chief Market Strategist

Phoenix Capital Research