I want to set the record straight on a few items.

Because I have spent the better part of two years focusing on the clear and obvious risks facing the financial system, most people seem to think I’m an endless pessimist. Some have even gone so far as to say I’m like the boy who “cried wolf.”

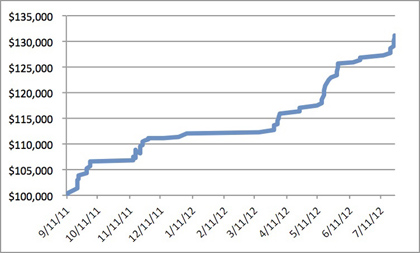

I’m not an endless pessimist. If anything I’ve been right far more times than the alleged “experts.” Case in point, between July 2011 and July 2012, my clients locked in 73 straight winning trades. Throughout this period we didn’t close a single losing position.

Our return over this period? 34%.

We did this with just stocks and ETFs, no options, no futures, no margin. Just stock picking. So obviously I’m not some mindless bear who simply laments how the system is at risk and has no clue how to make money from the markets.

Indeed, you don’t even need to follow my short trades to make money from my insights as the below testimonial attests.

Mr. Summers

I’ve been a subscriber for less than a year, and have

analyzed the trades I’ve done following your

recommendations. I don’t do short sales and don’t

trade options, so this is all from long positions.

My annualized return on investments is 55%,

which frankly impresses the heck out of me…

Thanks,

~Craig H.

So… yes, I tend to be very concerned about what’s happening in the economy and the financial markets. I’m even more worried that 99% of the investment community seems to think that Central Bankers will solve these problems. Seeing as the ECB and IMF combined couldn’t even solve Greece’s problems, I wonder just how sensible it is to assume they can get us out of the mess we’re in. As for the US Federal Reserve… I wonder, given than QE 1, QE lite and QE 2 failed to fix the US’s banking systems solvency issues (let alone fix the US’s economy), I’m not sure they’ve got the answers either.

Bottomline: there are very real risks to the financial system. I do everything I can to warn investors about them… all the while showing them how to profit from the markets. To find out more about how I’ve done this…

Graham Summers