If you happened to simply glance over the headlines in the financial media over the last few months, you’d think the European Crisis was over.

In November, no less than France’s Prime Minister, Spain’s Prime Minister, and even Germany’s Finance Minister suggested that the worst is over for the Euro Crisis or that the Crisis as a whole was over completely.

Unfortunately for them, the markets don’t seem to agree. Indeed, EU markets have all topped or are in the process of topping and forming downtrends.

Italy stopped being in an uptrend months ago and is now in danger of taking out major support:

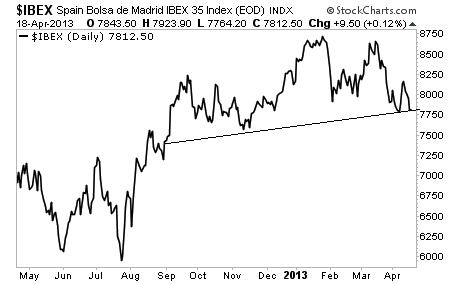

The same goes for Spain’s Ibex:

Even Germany’s stock market, the DAX, is breaking down in a big way.

What gives? Isn’t Europe doing great? Didn’t Mario Draghi promise to do everything he could to save the Euro?

Obviously European financials didn’t get the memo.

In the end, a Central Banker’s promise doesn’t have the binding power to hold together a $46 trillion banking system together… especially when that banking system is leveraged at 26 to 1.

Investors take note, the markets are sending multiple signals that things are not going well in the world. Europe’s markets are forecasting a nasty summer.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… having just seen another SIX trade winning streak…

To join us…

Best Regards,

Graham Summers