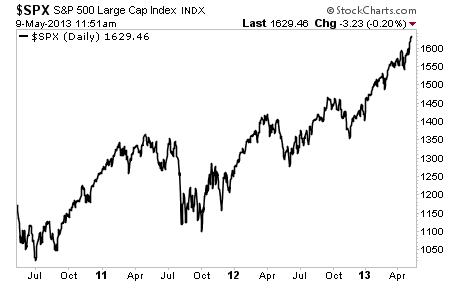

Stocks are officially in a blow-off top.

This is the culmination of Bernanke’s life’s work. In his mind he has succeeded in saving capitalism by spending trillions of Dollars pushing stocks higher.

It doesn’t matter that the US hasn’t experienced 3% GDP growth a SINGLE year since he took the Fed. It doesn’t matter that the employment ratio is at levels last seen back in the early ‘80s. It doesn’t matter that there are now a record number of Americans on food stamps.

All that matters is that stocks are up. That equals a recovery for the Fed.

This whole mess is sad really. Having seen two bubbles burst in the last 13 years, we all know how this ends: in disaster. And each time the disaster has been bigger. Indeed, the 2008 collapse was a far worse thing than the Tech Crash.

And what’s coming will be even worse than 2008. This time around, entire countries will go bust, not just banks.

On top of this, when this bubble bursts, interest rates will already be at zero and the Fed’s balance sheet swollen with garbage debts. The Fed and other Central Banks WON’T have the usual tools available to save the day.

If you are not already preparing for a potential market collapse, now is the time to be doing so.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… having just seen another SIX trade winning streak…

To join us…

Best Regards,

Graham Summers