Is it time to buy Gold miners?

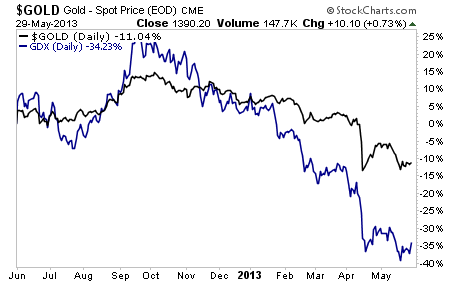

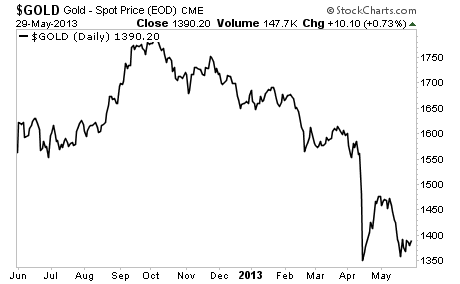

The precious metals mining sector was slammed with Gold’s sharp drop in prices in April. Mining companies are more “pie in the sky” than owning actual bullion, so mining shares typically move much more sharply than Gold does (see the figure below charting the price performance of Gold against the Gold mining ETF).

What’s interesting is that the Gold smackdown occurred just a few weeks before the Fed leaked that it was considering tapering its QE program. We know for a fact that the Fed has a tendency to leak critical information to its cronies and connected insiders. Looking at how Gold moved just a few weeks before the word “taper” was picked up by the media, one wonders if the Fed hinted what was coming to the connected few before the rest of us.

Regardless of Fed shenanigans, the Gold smackdown hit mining companies the hardest. As a result of this, numerous mining companies were trading at only slight premiums to their cash levels. With no debt on their books you were essentially getting their Gold reserves and infrastructure for free (provided there wasn’t too much political risk).

All you needed was for mining companies to bottom out… which looks to be happening now.

I alerted subscribers of my Private Wealth Advisory newsletter to this situation a few weeks ago, telling them about six mining companies in particular that were priced at bargain basement prices given their fundamentals.

As I write this, ALL of them are exploding higher. We’ve already closed out one for a 7% gain. And the others are destined for double digits in the coming weeks.

To find out their symbols and receive my hard-hitting analysis of their fundamentals, all you need to do is take out a subscription to Private Wealth Advisory.

Private Wealth Advisory is bi-weekly investment newsletter focused on providing individual investors with profitable investment ideas (using stocks and ETFs) in a two to six week timeframe.

In the last month alone, we’ve locked in gains of 7%, 12%, 21% and 25%… the average holding period was 18 days.

If you’re an individual investor looking for a guide to help you grow your portfolio with minimal risk, this is it!

To learn more about Private Wealth Advisory and take out a trial subscription (we offer a 30 day money back guarantee if you’re not satisfied)…

Best Regards,

Graham Summers