“Somebody” moved in to support stocks last week on Thursday.

The 50-DMA has become the “line in the sand” on the S&P 500. Anytime the market has come close to breaching this level in the last few months, “someone” has stepped in and propped the market up.

It’s pretty clear who the “someone” is. Given that the Fed is openly citing the stock market as an indication that QE is working… and given that every other metric shows QE is a total failure…

With that in mind, last Thursday’s action and the follow through Friday should be seen as a clear intervention.

This will end very very badly.

- Margin debt levels (meaning debt that investors take on to buy stocks) are at record highs.

- Hedge fund stock ownership is at levels last seen before the 2008 Crash.

- We’ve had multiple Hindenberg Omens (signs of a potential Crash).

All of the signs are in place: the market has become a complete bubble. When you compare the market to its fundamentals, it’s arguably an even worse than the bubble that brought about the 2008 collapse.

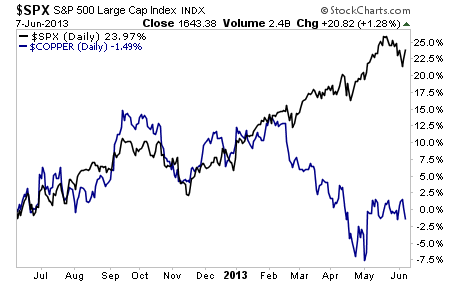

Take a look at the divergence between stocks and Copper. Stocks could fall over 20% before they’d realign.

I’ve been warning subscribers of my Private Wealth Advisory newsletter that we were heading for a dark period in the stock market. We’ve since taken action to insure that when the market falls, we make money.

Indeed, in the last month alone we’ve seen gains of 8%, 12%, 21%, and 28%… all from basic stocks and bonds. And we’re now preparing with six carefully targeted investments that will pay out when the market falls.

To find out what they are, all you need to do is take out a trial subscription to Private Wealth Advisory. You’ll immediately be given access to the Private Wealth Advisory archives outlining our investment strategies.

You’ll also be given access to FIVE Special Reports (an $800 value) outlining the biggest risks to the financial system as well as the best means of protecting yourself and your loved ones from them.

To take out a trial subscription to Private Wealth Advisory and take action to make sure the coming months are a time of profit, not pain.

Best Regards,

Graham Summers