Some truly awful economic results were released over the last week.

First and foremost, we discovered that 80% of the US adults struggle with joblessless, are near poverty, or have a reliance on welfare for at least part of their lives.

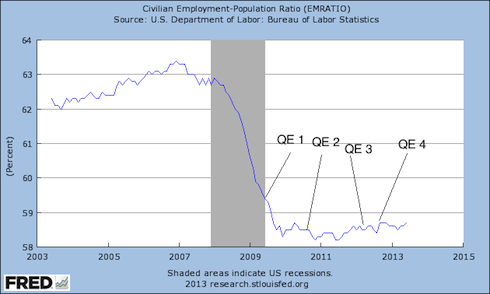

This is truly extraordinary. I’ve noted before that the employment ratio (the number of Americans of working age who have jobs divided by the total number of Americans of working age) indicates that there has been little if any real recovery in the jobs market. But the fact that four out of five adults is struggling truly shows just how endemic economic weakness is in the system.

It’s also a stunning rebuke of the Federal Reserve’s claim that its policies help Main Street. Below is a chart indicating the impact of QE(s) 1,2,3, and 4 on the employment population ratio. All told, we’ve spent over $3 trillion… and the ratio has barely moved higher.

Despite this incredible amount of money printing, the US economy has failed to recover in any meaningful way. Indeed, we have not had a single year of 3% GDP growth since Bernanke took the help as Fed Chairman.

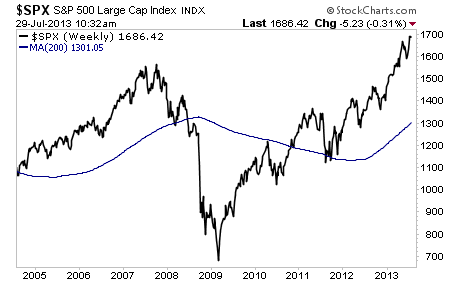

Instead, all we’ve got is a new stock market bubble. Investing legend Jim Chanos recently noted that today more companies are trading over 3X their book value than in March 2000 (at the height of the Tech Bubble).

I also want to note that the stock market today is more stretched over its 200-weekly moving average than it was at the height of the Housing Bubble. Once this market really begins to correct, we could easily fall to this line (currently 1300 on the S&P 500).

And if things get VERY ugly we’ll take this line out and crash to new lows.

It’s just like 2007 all over again. Only this time around, we know for a fact that the Fed hasn’t fixed things and has bankrupted itself and the financial system pretending that it can.

This is not doom and gloom. This is a fact. The Fed has created an even bigger bubble than the 2007 one.

The time to prepare for this is not once the collapse begins, but NOW, while stocks are still rallying. Stocks take their time moving up, but when they crash it happens VERY quickly.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in nine winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers