Traders shot for and managed to hit 1,700 on the S&P 500. At this point, there is no real reason for this other than trader games (start of the month buying).

The rising wedge pattern we’ve been tracking is essentially complete. This final jump in the S&P 500 has been a bounce from the upper trendline. But by the look of things, this is likely the final push.

The biggest driver of equity prices is corporate earnings. The only real reason stocks are moving up is based on the belief that the US economy is about to coming roaring back and corporate profits will soar.

This is a totally misguided viewpoint. Financials are the single biggest contributors for earnings growth in the S&P 500. These earnings are entirely fiction based on accounting gimmicks, not real money being made.

Ex-financials, the S&P 500’s earnings for the second quarter are DOWN 2.3%.

There is a word for this kind of market, it’s BUBBLE.

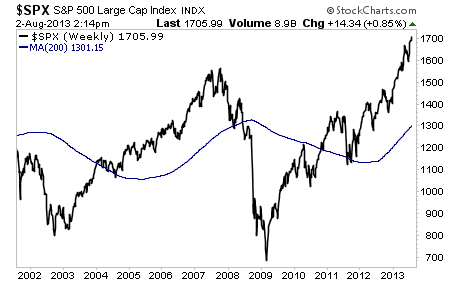

Take a look at how extended the weekly S&P 500 chart is above the 200-week moving average.

So we have a super overextended stock market on a collapsing economy and weaker corporate profits.

What could go wrong?

The Great Crisis, the one to which 2008 was just a warm up, is approaching. The time to prepare for it is BEFORE the US stock market bubble bursts.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in nine winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers