Asia has become the most important issue for the markets today. The Central Bankers’ dream of endless QE has become a nightmare for Japan while China’s “growth miracle” is rapidly falling to pieces.

Let’s start with Japan.

Japan launched its “shock and awe” mega-QE policy in April 2013. Having already launched eight QE programs over the last 20 years (equal to 20% of Japan’s GDP), Japan has only experienced two years in which GDP growth has exceeded 3%.

Despite this failure, Japan’s political leadership, lead by Shinzo Abe opted to increase its QE efforts, announcing a QE program equal to $1.4 trillion, roughly an additional 20%+ of Japan’s GDP.

The hope was that this massive stimulus would result in an uptick in GDP and employment.

Unfortunately, neither has picked up. Japan’s June industrial production fell 3.3% month over month in June. Household spending unexpectedly dropped 2% month over month for the same time period.

At the same time, inflation is beginning to rear its head.

Japan’s consumer price index registered its first increase in 14 months in June. The pace of increase was the fastest since 2008 when commodity prices were at record highs.

This is a huge problem. If the cost of living in Japan continues to rise without a commensurate rise in incomes or GDP, then Japan is finished as the benefits of monetary intervention will have been completely overcome by the negative consequences.

Another key development for the global economy that needs to be monitored is the collapse of China.

The mainstream financial media continues to proclaim that China’s liquidity crisis is solved and that the Chinese economy is growing at 7%.

However, we get confirmation of a slowdown in China via the latest round of corporate results there.

Consider that:

- Apple just reported a 14% drop in Net Sales for operations in China.

- Yum! Brands (owns Taco Bell, KFC, etc.) saw a 7% drop in sales in China.

- Cosco Shipping (China’s largest shipping group) saw its first half net loss triple.

- Anglo American, a mining group producing coal, iron ore and precious metals with large exposure to China, saw a 34% in pre-tax profits in the first half of 2013.

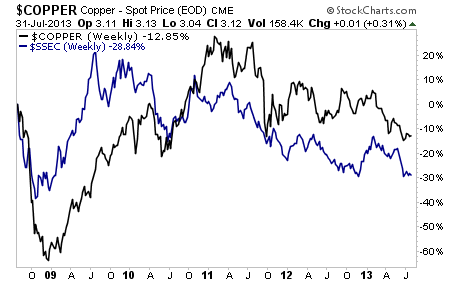

I also note the collapse in Copper (black line), which is closely mirroring the collapse of China’s stock market (blue line) below.

Combined, China and Japan account for roughly 18% of Global GDP. They are the second and third largest countries in the world respectively. The fact that the former is definitively in a hard landing while the latter is facing systemic unrest will not be something the markets can ignore for long.

On that note, I’ve already prepared readers of my Private Wealth Advisory newsletter with a number of targeted investment strategies designed to help them not only manage risk, but produce outsized profits during the coming Crash.

My clients saw a 7% portfolio return in 2008, at a time when the market fell 35%.

We also locked in 73 straight winning trades during the Euro Crisis, producing a total portfolio return of 34% at a time when the market was falling rapidly.

And today, we’re taking action to prepare for another round of intense volatility. In fact, we’ve already started another winning streak, having locked in 13 straight winners since May. And by the look of things, we’re about to close our 14th and 15th shortly.

If these sound like the kind of investment strategies you could use for your portfolio, I suggest taking out a trial subscription to Private Wealth Advisory. You’ll immediately begin receiving my bi-weekly investment reports outlining the most important developments in the market.

You’ll also receive my real-time trade alerts, telling you the minute it’s time to open or sell a trade.

All just for $299 a year.

You get:

- 26 bi-weekly investment reports (ranging from 15-30 pages in length)

- Six Special Reports outlining unique opportunities and risks in the markets that 99% of investors don’t know about.

- 30-50 trades per year provided to you in real time

- The sense of calm in knowing that you’ve got your financial house in order.

To sign up for Private Wealth Advisory…

Yours in Profits,

Graham Summers

Chief Market Strategist

Phoenix Capital Research