Here’s the news worth knowing about today:

1) Europe is not fixed. The EU just announced record high unemployment with unemployment numbers rising nearly one million thus far in 2013.Greece, which was hoping to increase taxes or grow its way out its debt problems has just revealed that over 500,000 companies cannot pay their taxes (up from 182,000 last month). So much for the “Europe is fixed” theme.

We believe the crisis will re-emerge later in 2013 or early 2014. The key item to watch is the German Dax. Whenever it comes back to test the upper trendline in the chart below, things will start getting messy again.

2) China is engaging in the same taper/no-taper verbal interventions as the US. The Chinese premiere warned against loose monetary policy last night and China’s market dropped.

The People’s has a major problem on its hands (several actually). The primary one pertains to inflation. China has flooded its financial system with credit and easy money in ways that Ben Bernanke never dreamed of.

As a result of this inflation is rising, which leads to wage strikes, which erases profit differentials between China and other manufacturing centers, which leads to manufacturers pulling out of China, which results in a weaker Chinese economy, which results in the need for more credit to sustain growth and finance more projects.

This has resulted in a sideways Chinese stock market with every new flood of liquidity kicking off rallies and every talk or taper or tightening causing corrections. At some point this will break and we’ll either collapse or skyrocket depending on whether we see a debt deflationary collapse or a debt deflationary collapse accommodated by rampant monetization which would result in a Zimbabwe-esque stock market rally.

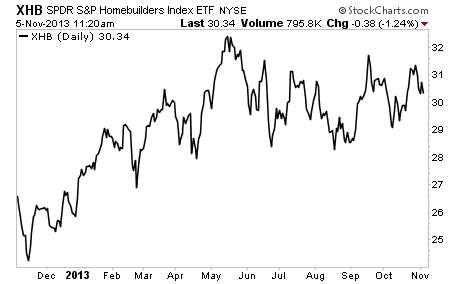

3) In the US, the housing market is definitively in a bubble. And it is once again popping.

Over 50% of all home purchases are cash only. In California, the amount of median income needed to buy a home is virtually identical to the Bubble Years of 2005-2006.

Mortgage applications are plunging and sales are stalling (we’ve been flat for two months but are down 27% since June). Be aware of this. Homebuilder stocks seem to be sensing something is amiss. We’ve been moving sideways since the peak in May 2013.

These are the trends to be away of.

Best Regards

Phoenix Capital Research