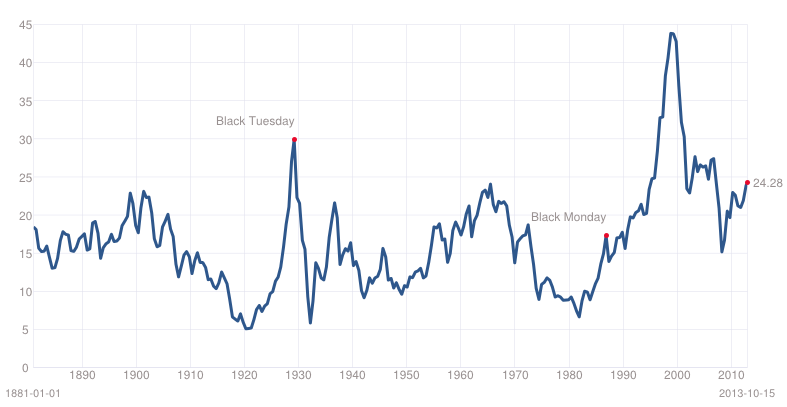

The market is overpriced, to be sure. I’m gauging this on the single most important valuation metric in finance: the cyclically adjusted price-to-earnings ratio or CAPE ratio.

Generally speaking, most investors price a company based on its current Price to Earnings or P/E ratio. Essentially what you’re doing is comparing the price of the company today to its ability to produce earnings (cash).

However, corporate earnings are heavily influenced by the business cycle.

Typically the US experiences a boom and bust once every ten years or so. As such, companies will naturally have higher P/E’s at some points and lower P/E’s at other. This is based solely on the business cycle and nothing else.

CAPE adjusts for this by measuring the price of stocks against the average of ten years’ worth of earnings, adjusted for inflation. By doing this, it presents you with a clearer, more objective picture of a company’s ability to produce cash in any economic environment.

I mentioned before that CAPE is the single most important metric for long-term investors. I wasn’t saying that for impact.

Based on a study completed Vanguard, CAPE was the single best metric for measuring future stock returns. Indeed, CAPE outperformed

- P/E ratios

- Government Debt/ GDP

- Dividend yield

- The Fed Model,

…and many other metrics used by investors to predict market value.

So what is CAPE telling us today?

Today the S&P 500 has a CAPE of over 24. This means the market as a whole is trading at 24 times its average earnings of the last ten years.

Put another way, if you bought the entire stock market today, it would take you roughly 24 years to make your money back.

That’s expensive. Indeed, the market has only been this expensive a handful of times in the last 100+ years. Every time we’ve been closer to a market top than a new bull market run.

However, this is not to say that there are not tremendous opportunities for stock pickers in this environment.

Indeed, recently, subscribers of our value stock picking newsletter Cigar Butts & Moats locked in a 28% gain on our latest stock pick in less than one month.

We did this by buying a deeply undervalued business. Based on its market valuation, this company could easily take itself private, using the cash generated from operations to pay the loan required to buyback all of its shares on the open market.

In fact, this business was so cheap that it could do this even if its earnings fell in HALF.

That’s one heck of a margin of safety. We bought on October 3 2013. And we closed out on October 23 2013 for a 28% gain.

Over the same time period, the S&P 500 rose just 4%.

This is how to make a killing in the market today: by focusing on value stock picking. It’s the very reason we launched Cigar Butts & Moats.

The price of an annual subscription to Cigar Butts & Moats is just $79.99.

For that price you get:

- 12 monthly issues of Cigar Butts & Moats

- Our proprietary deep value Investment Special Report How to Make a Fortune With Value Investing (a $199 value) which outlines specifically how Warren Buffett made his fortune investing in stocks.

- All of our other Special Investment Reports outlining special investment opportunities.

- Real time investment updates as needed (like the one that told investors to lock in a 28% gain).

All of this for just $79.99.

To take out an annual subscription to Cigar Butts & Moats…

Best Regards

Phoenix Capital Research