Resource pressure is a constant. As we continue to track the nearly delusional energy “debate” in the United States about whether we will continue to burn coal and whether natural gas is a panacea, China continues to struggle with the sufficient acquisition and deployment of resources to support economic growth.

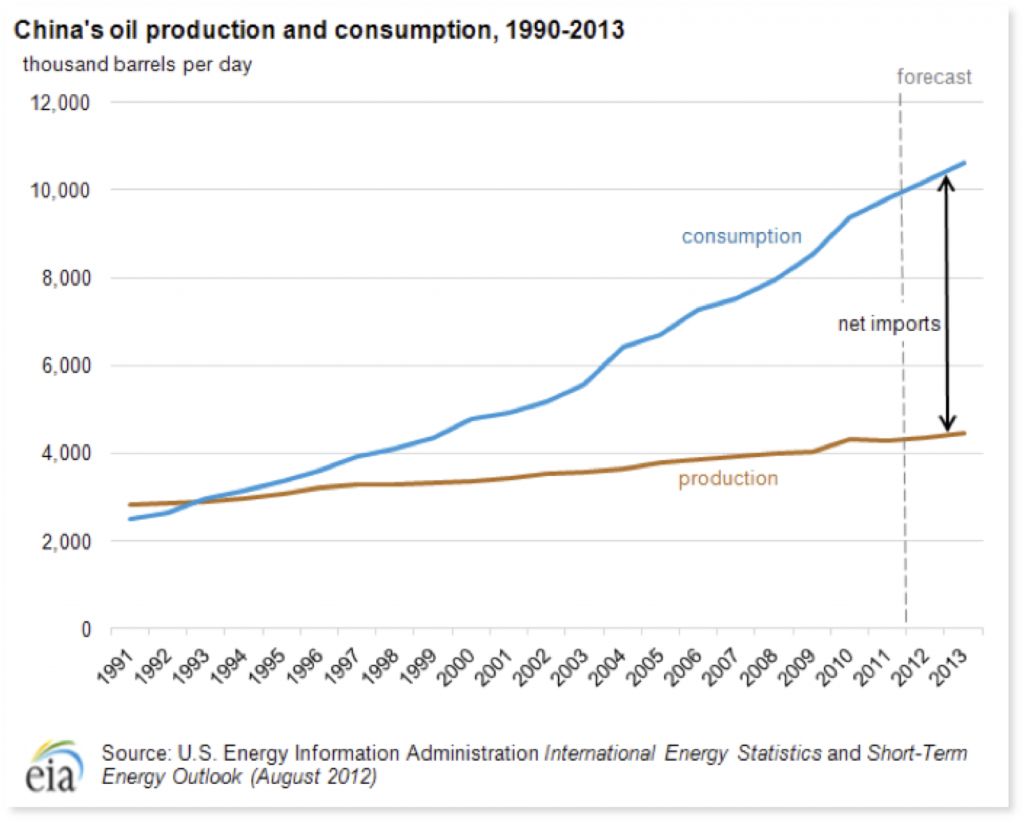

China has an environment versus growth problem. Already China is the #1 importer of oil in the world. That‘s right. China imports more oil than the United States. By itself that comment is meaningless because it reflects greater US oil production, substitution by natural gas, and significant and increasing energy efficiency gains.

The United States can hold energy consumption growth below GDP growth with efficiency gains and because of the greater percentage of service relative to the economy. China cannot.

Chinese oil consumption will continue to rise. China, however, has an emerging and growing middle class that wants to buy a car, as is typical when annual GDP per capital hits $10,000-20,000 per year. We don’t need to see U.S. ownership rates – the population is 4X so even getting to half the ownership rate over time means twice as many cars.

Besides trail, buses, domestic aviation and trucks China is putting over 1 million cars every month onto its expanding road and highway network.

Which strains other sources of energy supply and water!

We find our best opportunities when we identify a huge gap between public perception and underlying reality.

Indeed, I recently outlined such an opportunity in the energy industry to readers of my Global Alpha Trader newsletter.

Even by conservative estimates, the upside potential for this trend is 400%. There is literally a $21 billion opportunity here. And the three specific companies I’ve outlined in a report The 400% Energy Opportunity Wall Street Won’t Tell You could all show gains between 500%-800% or even more.

This is what we do on a weekly basis with Global Alpha Trader: identify major trends that could show individual investors huge gains with minimal risk.

Every week I outline the most critical developments in the global economy, showing individual investors the opportunities where you can make BIG money and with minimal risk.

I’ve spent the better part of 30 years doing this for institutional clients, pension funds and the like. Now I’m doing it for you!

To find out what these companies are, all you need to do is take out a trial subscription to Global Alpha Trader. You’ll immediately be given access to the Global Alpha Trader subscribers only website where you can download my report: The 400% Energy Opportunity Wall Street Won’t Tell You.

You’ll also begin receive Global Alpha Trader to your inbox every Monday after the market closes.

Now, a subscription to Global Alpha Trader costs $995.

If that sounds like too much money – I can tell you right now Global Alpha Trader is not for you. This research is for serious investors who understand that high quality investment ideas come at a premium: you don’t get insights with 400+% upside cheaply.

Of course, I can tell you about how successful this service has been… but the best way to judge is to check it out for yourself. So I propose you take the next two months to give Global Alpha Trader a look…

If you find it’s not what you’re looking for, simply drop us a line and we’ll issue a full refund.

To subscribe to Global Alpha Trader today…

Respectfully submitted,

Tom Langdon

Editor

Global Alpha Trader