No doubt you have read the statistics over the years that perhaps only 30% of investment managers beat the market. Even that statistic is misleading because of all the fees and taxes an investor should consider.

Mutual fund companies almost never warn you about your tax costs and also seek to hide performance lag.

Here is one example. OppenheimerFunds Main Street Fund has about $6 billion in assets and the overall strategy we would estimate runs perhaps $20 billion under portfolio manager Manny Govil, who took over the fund in May 2009 after building a successful track record at other firms.

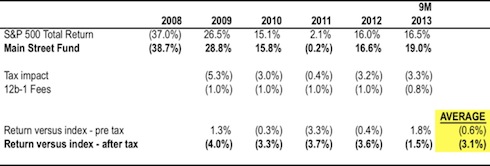

When you read their online materials the company will show returns that, on the surface, seem pretty good. Comparing the fund to the S&P 500 would suggest Main Street fund delivered value, outperforming in 2009, 2010, 2012 and the first nine months of 2013.

If you are a taxable investor pay attention to the fact that 20% of your profits will go to the government. This is also true if you select your own investments but unlike a fund you get to determine the timing of the tax liability.

Then you have the “marketing expenses.” Oppenheimer will charge you 5.75% so they can pay the broker who sells you the fund on the front through its Class A shares. Many people instead opt for a different share class that foregoes the upfront charge but has a “back end” load if you liquidate in the first few years.

Well, if you just hold it no problem, right? Wrong! If you opt for the no load route Oppenheimer will charge you 0.99% for “12b-1” fees instead of 0.24% as on the load fund. Does this extra charge help you? No. They use it to pay their sales people to gather more assets on the theory that more assets will spread the costs wider. Yet somehow the expense ratio on these funds will never go down.

In the end, even with an above average money manager like Manny Govil running this fund the average investor will lose about (3%) annually when all the costs are factored in.

Remember, keep your costs down and only pay for value.

And when it comes to value… we suggest looking for companies that pay you to own them with hefty dividends…

I call them Low Risk Dividend Growers or LRDGs. And they are the primary focus of my dividend product, Big Dividend Investor.

With interest rates at roughly 0% today, it’s absolutely critical to find investments that will show you a solid return on your money.

Companies can massage their earnings any number of ways… but dividends mean CASH IN HAND.

Consider my latest pick for Big Dividend Investor … if pays a whopping 7% dividend to investors. And because the payments are made monthly this is a literal second stream of income for investors.

And best of all, because of its corporate structure, this 7% yield is virtually TAX FREE.

THAT’s what I mean by Low Risk Dividend Growers.

So if you’re an individual investor who is looking for investment income, I highly recommend you give Big Dividend Investor a try. I’ve made investors hundreds of thousands of dollars in investment income over the last ten years… and I can do the same for you with a subscription to Big Dividend Investor.

All for the low price of $99.99.

To learn more about Big Dividend Investor and how it shows investors the most extraordinary dividends on the market…

Profitably Yours,

Buck Wilson