The market leaders are collapsing.

Market tops usually feature something called rotation. This occurs when investors move out of former top performing companies or market leaders, into safer investments.

Because of this, one of the most critical items to observe is how market leaders are performing.

Right now they’re breaking down in a big way.

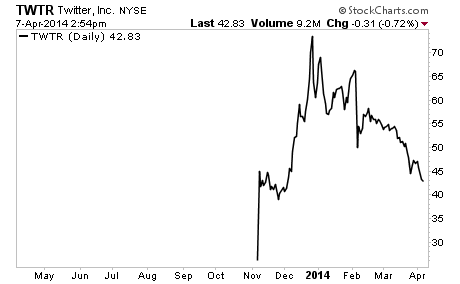

Twitter, which nearly doubled after its IPO in late 2013, has absolutely collapsed.

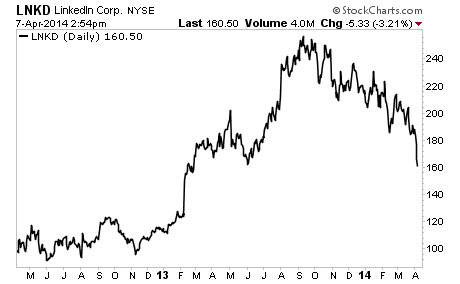

LinkedIn, another former market leader, has broken down, destroying its upward momentum.

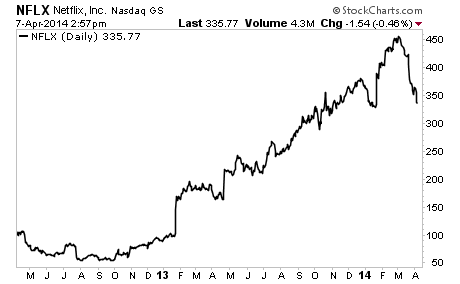

Netflix is also in big trouble:

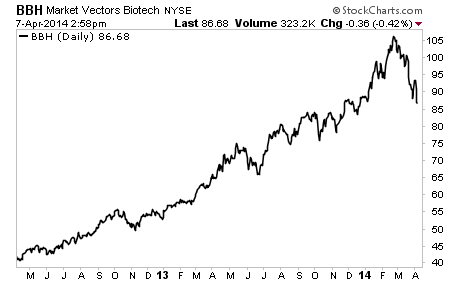

And the biotech sector as a whole (one of the top performing sectors in 2013) looks to be collapsing:

So while the market as a whole remains in a solid uptrend, these stocks are hinting that more serious danger lies ahead.

Be aware, there are warning signs flashing throughout the financial system…

With that in mind, We’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

All for the the small price of $179: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Phoenix Capital Research