We have entered a very dangerous stock market.

On one side we have entered a period that historically is very weak for stocks. The old adage “sell in May, go away” is based on the fact that the period from May to November has historically been a very weak one for stocks.

According to the Ned Davis (NDR) database, had you invested $10,000 in the S&P 500 every May 1st starting in 1950 and sold October 31 of the same year, your initial position would only be worth $10,026 as of 2008. Put another way, by investing only from May through October, a $10,000 stake invested in 1950 would have only made $26 in 57 years.

In contrast, $10,000 invested in the S&P 500 on November 1st and sold April 30th over the same time period would have grown to $372,890. Out of 58 years, you would have had 45 positive and only 13 negative.

So the period from May to November has historically been a very weak one for stocks.

However, on the other side of the equation, the Federal Reserve has conditioned investors to believe that no matter what happens, the Fed or someone else will step in to hold the stock market up should things get hairy.

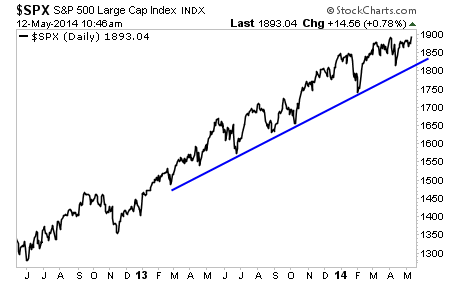

Time and again, whenever stocks came dangerously close to breaking down, “someone” would step in and prop the market up. You can see the moves clearly in the chart below.

Thus, traders have been conditioned to move aggressively into stocks the very moment that the market hits support. This makes for a very bullishly biased environment, a fact confirmed by the record amount of bullishness and margin debt in the system today.

And so we are in a very dangerous environment. One on hand, the market is overbought and due for a pullback. On the other hand, investors at large only believe stocks can move up.

At some point, the market will call this bluff. Given the sheer number of issues in the world today (Ukraine, China’s economic slowdown, the weakness of the US economy, Europe’s ongoing debt crisis, etc.) there is no shortage of potential black swans out there.

The question is, how to determine when it’s time to run for safety.

Be aware, there are warning signs flashing throughout the financial system…

With that in mind, We’ve already urged Private Wealth Advisory clients to start prepping. We’ve opened three targeted trades to profit from the stock bubble bursting. As we write this, all of them are roaring higher.

We’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

All for the the small price of $179: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Phoenix Capital Research