Stocks rallied yesterday on the announcement (what is this, the 105th?) that Greece’s problems had finally been solved.

The whole charade is tiresome. I say charade because the ECB doesn’t give a hoot about Greece other than the fact that some of its bonds are used as collateral by large European banks for their derivatives trades.

Put it this way, the ECB is a lot more concerned with Deutsche Bank’s €54 TRILLION in derivatives exposure than it is with the state of malnutrition for Greek children or any other number of appalling data points coming out of Greece.

On that note, Greece accepted a bailout extension. It never really had a choice in the matter. With billions of Euros fleeing the country’s banking system, Greece’s choices were A) accept the ECB’s offer or B) face complete systemic financial collapse.

Interestingly, the Euro fell on the news. One would think that the Euro remaining together was Euro positive. One would be wrong. Either the market doesn’t believe the Greek deal is legit, or something else is at work here.

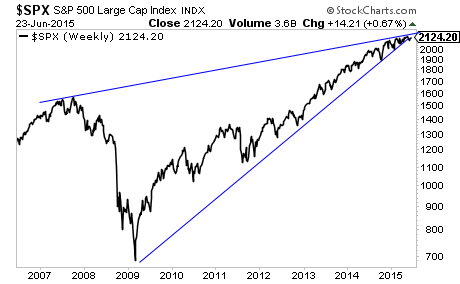

The whole mess really feels like a sideshow to the fact that stocks are now beyond nosebleed territory as far as valuations are concerned. And they are just completing a six-year bearish rising wedge pattern at a time when earnings are collapsing at a pace not seen since 2009 when the financial system was in a meltdown.

The completion of this pattern will take time to unfold. But it predicts a MASSIVE collapse in stocks.

Smart investors should take note of this now. It is a MAJOR red flag to be watched closely.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 50 left.

To pick up yours, swing by….

http://www.phoenixcapitalmarketing.com/roundtwo.html

Best Regards

Phoenix Capital Research