Yesterday we assessed how elements of the financial media are either unbelievably lazy or completely complicit in helping to maintain the illusion of success for the Centralized powers (large governments and Central Banks).

Today we move on to addressing how the political class and Central Banks are unable resolve debt issues in any meaningful way.

Going into its financial crisis in 2009, Greece had a GDP of $341 billion. To put this into perspective, it’s roughly the size of the state of Maryland. Greek debt was roughly $370 billion that year, giving Greece a Debt to GDP ratio of about 108%.

It’s a strikingly small amount of money for a collective economy of nearly $18 trillion (the EU). Indeed, Greece contributes only 2% of the EU’s total GDP. And yet, the ECB working with the IMF has not been able to resolve Greece’s issues.

Let’s let that simmer for a bit…

A Central Bank, working with the IMF was unable to resolve a debt issue for a country that comprises less than 2% of the economy of which the Central Bank is in charge.

How is this possible?

First and foremost, the ECB had little if any interest in Greece’s well-being as an economy. For the ECB, the “Greek issue” was really more of a “large European bank issue.” In that regard, the ECB was focused on one thing.

That issue is collateral.

What is collateral?

Collateral is an underlying asset that is pledged when a party enters into a financial arrangement. It is essentially a promise that should things go awry, you have some “thing” that is of value, which the other party can get access to in order to compensate them for their losses.

For large European banks, EU nation sovereign debt (such as Greek sovereign bonds) is the senior-most collateral backstopping hundreds of trillions of Euros worth of derivative trades.

This story has been completely ignored in the media. But if you read between the lines, you will begin to understand what really happened during the last two Greek bailouts.

Remember:

1) Before the second Greek bailout, the ECB swapped out all of its Greek sovereign bonds for new bonds that would not take a haircut.

2) Some 80% of the bailout money went to EU banks that were Greek bondholders, not the Greek economy.

Regarding #1, going into the second Greek bailout, the ECB had been allowing European nations and banks to dump sovereign bonds onto its balance sheet in exchange for cash. This occurred via two schemes called LTRO 1 and LTRO 2, which were launched on December 2011 and February 2012 respectively.

Collectively, these moves resulted in EU financial entities and nations dumping over €1 trillion in sovereign bonds onto the ECB’s balance sheet.

Quite a bit of this was Greek debt, as everyone in Europe knew that Greece was totally bankrupt.

So, when the ECB swapped out its Greek bonds for new bonds that would not take a haircut during the second Greek bailout, the ECB was making sure that the Greek bonds on its balance sheet remained untouchable and as a result could still stand as high grade collateral for the banks that had lent them to the ECB.

So the ECB effectively allowed those banks that had dumped Greek sovereign bonds onto its balance sheet to avoid taking a loss… and not have to put up new collateral on their trade portfolios.

Which brings us to the other issue surrounding the second Greek bailout: the fact that 80% of the money went to EU banks that were Greek bondholders instead of the Greek economy.

Here again, the issue was about giving money to the banks that were using Greek bonds as collateral, to insure that they had enough capital on hand.

Piecing this together, it’s clear that the Greek situation actually had nothing to do with helping Greece. Forget about Greece’s debt issues, or protests, or even the political decisions… the real story was that the bailouts were all about insuring that the EU banks that were using Greek bonds as collateral were kept whole by any means possible.

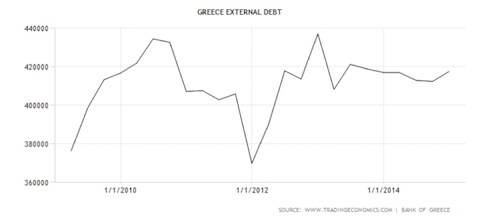

This is why the ECB and the IMF failed to “fix” Greece. Indeed, the below chart makes it plain that all of the bailouts didn’t actually do anything to solve Greece’s debt problems: the country’s external debt has actually barely budged since 2010!

Note that after a brief dip in 2011-2012, Greece’s external debts rose right back to where they were in 2010 at the beginning of the debt crisis. Moreover, because Greek GDP dropped along with its debt levels in 2011-2012, the country’s Debt to GDP ratio has effectively flat-lined.

In short… neither of the first two bailouts actually solved ANYTHING for Greece from a debt perspective. Between this and the collateral discussion from earlier, the evidence is clear: the ECB has no interest in fixing Greece’s problems. Both bailouts were nothing but a backdoor means of funneling money to the large European banks using Greek debt as collateral on their derivatives trades!

Another Crisis is brewing. It’s already hit Greece and it will be spreading throughout the globe in the coming months. Smart investors are taking steps to prepare now, before it hits.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We are making 1,000 copies available for FREE the general public

We are currently down to the last 25.

To pick up yours, swing by….

http://www.phoenixcapitalmarketing.com/roundtwo.html

Best Regards

Phoenix Capital Research