The Fed missed its chance.

Truth be told, the Fed should have raised rates in 2011 or 2012. Even if the Fed had an excuse not to at those times, it should have hiked them in April 2014, when we hit its unemployment rate target of 6.5% (assuming this number is correct).

Instead the Fed opted to keep rates at zero, as it also did in April of 2015, June of 2015, and now September of 2015.

Indeed, a whopping 82% of economists thought the Fed would hike rates in September. The whole market believed it too. So why didn’t the Fed do it? Just how much prepping do we need for a measly 0.10%-0.25% increase in rates after six years of ZIRP?

So now we’re well into 2015 and the US is moving back into recession at a time when rates are at zero.

The Fed’s own GDPNow measure shows that GDP grew at a measly 0.9 in 3Q15.

As Not Jim Cramer recently noted, all of the September Manufacturing data suggested a collapse in GDP.

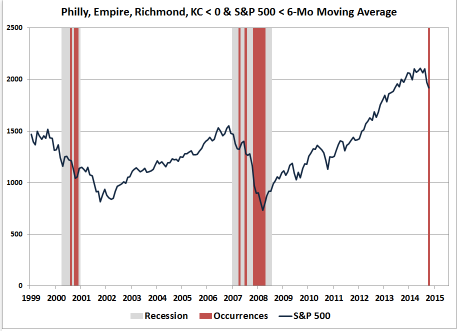

Indeed, as Bill Hester recently noted, all four of the Fed’s September Purchasing Manager Index (PMI) readings (Philadelphia, New York, Richmond, and Kansas City) came in at readings of sub-zero. This ONLY happens when you are already 4-5 months into a recession.

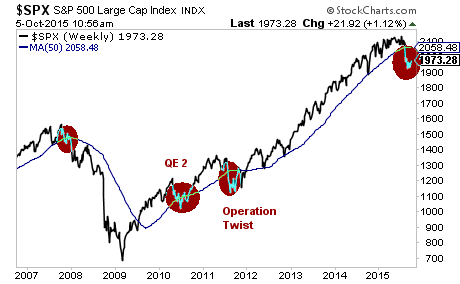

In short, the economic data is a disaster, suggesting the US is entering if not already in a recession. Moreover, stocks have taken out critical support at the 50-week moving average.

Historically this has been THE line for bull markets. We sliced through it like a hot knife through butter last month. The market has done this twice in the last six years. Both times it was saved by a new Fed policy: QE 2 and Operation Twist, respectively.

However, this time around, the Fed’s hands are tied by the fact that it is in the political cross hairs: ample research has shown that QE increases wealth inequality… and we’re approaching a Presidential election in the US.

In short, the only thing holding the market up is hype and hope of more QE. But this is missing the point…

The bull market of the last six years is over.

Already investors have begun to realize that Central Banks have lost control of the markets. This is why they erased months’ worth of gains in four days’ time.

Smart investors are preparing for a collapse NOW, BEFORE it hits.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 10 left.

To pick up yours, swing by….

https://www.phoenixcapitalmarketing.com/roundtwo-GS.htm

Best Regards

Phoenix Capital Research

Our FREE e-letter: www.gainspainscapital.com