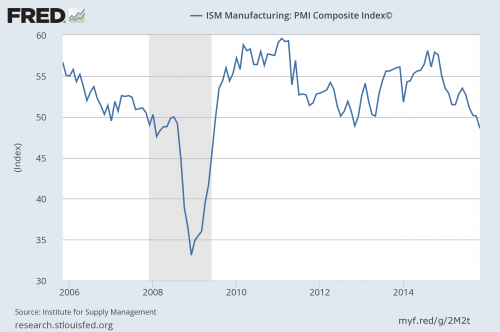

Yesterday, the recession we predicted as much as six months ago was formally noted in the ISM data, with November’s ISM coming in at sub-50.

I’d been noting to clients since at least May that numerous data points had flashed “recession” for the US economy. Among the list of warnings signs were severe declines in corporate profits, Regional Manufacturing Surveys and Merchant Wholesaler Sales.

However, until yesterday, ISM had remained above 50. And so the financial media clung to that data point as indicating that the US economy continued to expand.

Not anymore.

An ISM below 50 indicates a recession. However, we probably won’t hear a formal announcement that the US is in recession until mid-2016 (remember that we were well into the 2008 Crisis before the Feds revealed that the US had entered a recession back in late 2007).

An ISM below 50 indicates a recession. However, we probably won’t hear a formal announcement that the US is in recession until mid-2016 (remember that we were well into the 2008 Crisis before the Feds revealed that the US had entered a recession back in late 2007).

And the Federal Reserve is about to hike interest rates.

This is only going to accelerate the economic downturn. Indeed, we fully believe that the global economy is already contracting, with China, Japan, and now the US in technical recession.

In China, the official growth numbers suggest GDP is growing by 7.3%, however… China’s electricity consumption suggests GDP growth is 3% at best.

China’s rail freight volume for the first eight months of 2015 fell 10.1% from the comparable period in 2014.

China’s monthly Caixin PMI reading has fallen to levels not seen since March 2009: when everyone thought the world was ending.

Let’s now turn to Japan, where the largest QE program in history was launched in April 2013, only to be increased in October 2014. This was a Keynesian dream come true: an amount of spending equal to 25% of GDP.

Since that time, Japan experienced an uptick in economic growth for two quarters before turning back down again. Which brings us to today.

Japan’s GDP shrank at an annualized pace of 1.2% in 2Q15. The country is now back in technical recession. Household spending fell 2.4% in October Year over Year (YoY). Analysts had forecast growth of 0.1%.

So, the world’s three largest economies, the US, China and Japan are all approaching if not already in recession. These countries represent nearly a third (29%) of global GDP.

Take note, the global economy is contracting again. And this is going to result in another stock market crash.

Smart investors are preparing now. The August-September correction was just a warm up. The REAL drop is coming shortly.

We just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

We are giving away just 1,000 copies for FREE to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research