Stocks will likely rally this week for the simple reason that it is options expiration week.

The Fed almost always gives Wall Street extra money to play around with during options expiration.

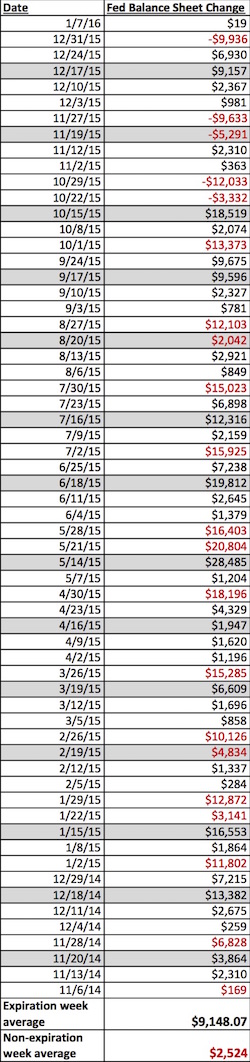

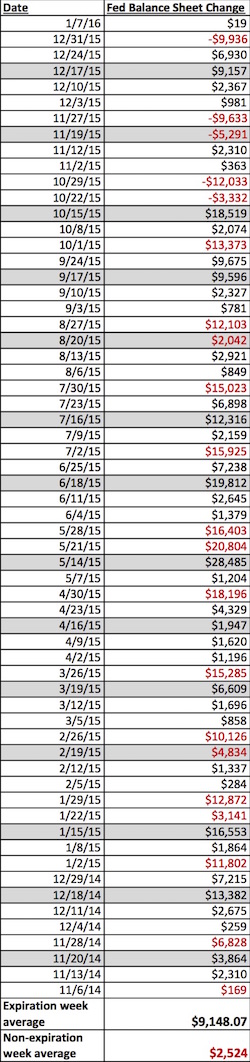

- On average the Fed expands its balance sheet by $9.1 billion during options expiration weeks (expansions means money flows into Wall Street banks).

- During non-options expiration weeks, the Fed contracts its balance sheet by an average of $2.5 billion.

Below is a table charting changes in the Fed’s balance sheet. Options expiration weeks are gray.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we are up 35% year to date.

Over the same time period, the S&P 500 is 0%.

That’s correct, with minimal risk, we are outperforming the S&P 500 by 35%… and the year isn’t even over yet! Heck, we just closed out another 35% winner yesterday!

Our next goes out tomorrow morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

Mind you, this is during a period in which the Fed is not engaged in Quantitative Easing or any other major monetary program. And yet… it still feels the need to hand off an average of $9 billion or so to Wall Street every time options expiration rolls around.

Note also, that the Fed gave Wall Street money almost every week during December. For some reason Janet Yellen felt the need to expand the Fed’s balance sheet by $18 billion during the last month of a year in which most fund managers had performed terribly.

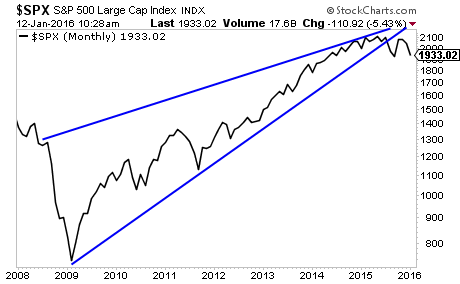

Despite this obvious gift to Wall Street, stocks finished 2015 DOWN. It was the first down year stock have experienced since 2008. And by the looks of the below chart, it’s only going to get worse in 2016!

If you’re an investor who wants to make big money from the markets, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Over the last 14 months we’ve closed out 48 straight winning trades. That’s an average of nearly FOUR winners per month.

And throughout this period, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS.

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research