Last month, the Bank of Japan implemented Negative Interest Rate Policy, or NIRP.

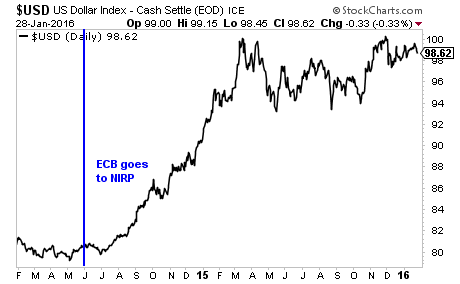

It is the second Central Bank to do so. The European Central Bank or ECB first went to NIRP in June 2014.

Thus, between Japan and Europe, over 20% of the world’s GDP is being managed by a Central Bank with NIRP.

More importantly, TWO major currencies in the world are now at NIRP while the US Dollar is at 0.5%.

Why does this matter?

Because hundreds of billions of Dollars in capital will be fleeing Japan to come to the US.

The US Dollar has been in a bull market since mid-2014. It is not coincidence that it started when the Euro first went to NIRP: the minute the EBC implemented NIRP money began fleeing the Euro and moving into the US Dollar.

There are over $9 trillion in BORROWED US Dollars sloshing around the financial system.

ALL of this DEBT is at risk of blowing up when the US Dollar began to rally. And now that both Europe AND Japan are implementing NIRP, the US Dollar bull market is only going to get worse.

How bad?

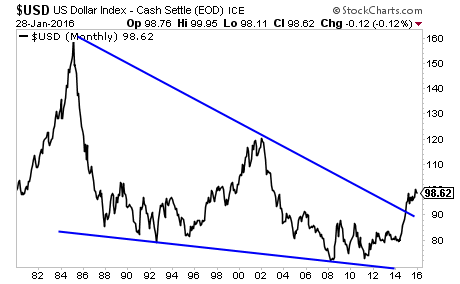

The US Dollar has broken out of the single BIGGEST falling wedge pattern in history. You are looking at a 40 year chart pattern that has been broken.

This tells us that something absolutely MASSIVE is happening in the financial system right now. That “something” is the beginning of a $9 trillion debt implosion.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And in the LAST FOURTEEN MONTHS, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research