What a different four weeks makes.

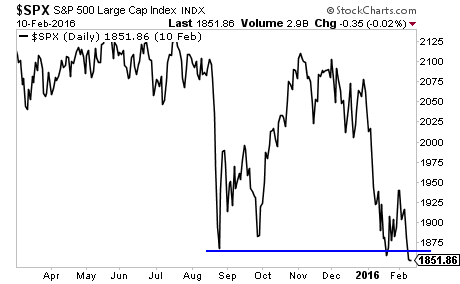

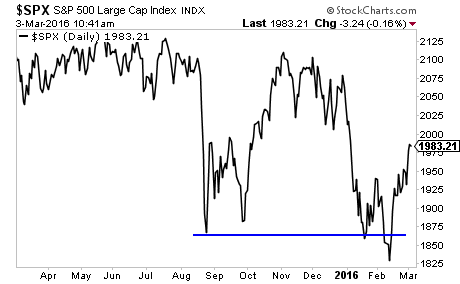

Four weeks ago, the S&P 500 had just taken out critical support. Everyone was panicking that the market was about to implode.

- At that time, China was continuing to devalue the Yuan as its economy collapsed.

- Europe was tumbling based on Draghi’s inability to generate inflation.

- The US economy was rolling over sharply as deflation arose courtesy of US Dollar strength and a Fed rate hike.

Since that time, not one of those issues has been resolved. The only thing that has changed is that the S&P 500 has rallied 9%.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we are up 17% year to date.

Over the same time period, the S&P 500 DOWN 8%.

That’s correct, with minimal risk, we are outperforming the S&P 500 by 25%… and the year only just started!

Our next goes out tomorrow morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

Indeed, if anything we are getting additional signs things are worsening outside of the stock market.

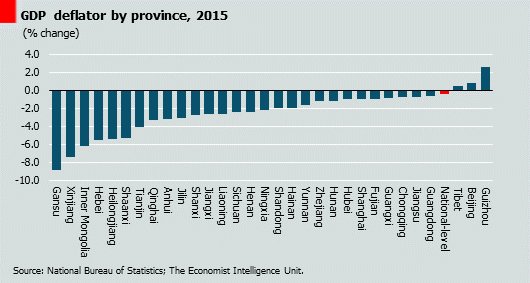

China’s economy is in a full-scale collapse. According to electricity consumption the country’s economic activity is NEGATIVE. Indeed, 28 out of 31 provinces had a NEGATIVE deflator for 2015. China as a whole is in recession if not outright deflation.

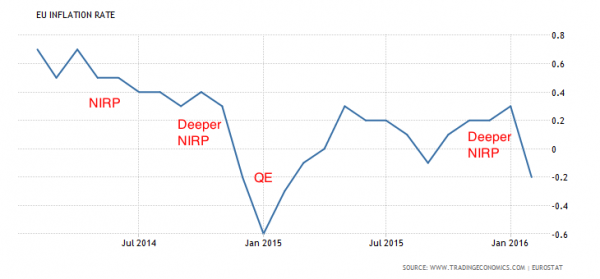

Europe just posted negative inflation. Mario Draghi has cut rates into NIRP three times and spent over €670 billion. This bought at best a year’s worth of uptick in inflation data.

And finally, the US continues to post worsening economic data. US services have slumped into contraction just as we predicted (manufacturing has been in a recession since mid-2015).

And the Fed is hiking rates?

Another crisis is coming. Nothing has changed since February 9th. Markets have rallied on hype and hope of more stimulus, but that will only go so far. The business cycle has turned. And credit is SCREAMING that something BIG is coming down the pike.

Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research