Will stocks collapse 24% (a Crash) in the next three months?

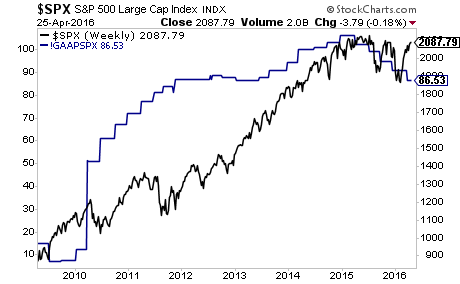

For the first time since the 2009 bottom, Earnings Per Share (EPS) have diverged sharply to the downside from stocks.

There are a lot of reasons why investors buy stocks… but at the end of the day, they all boil down to earnings: the company is only a sound investment if it actually makes money.

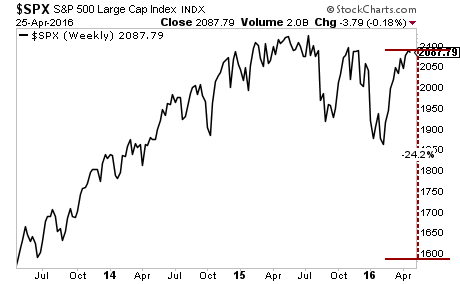

The above chart shows us that earnings recently peaked and have diverged sharply from stock prices. Here’s a close up of the last three years:

By this analysis, stocks could easily fall to 1600 to return to a proper valuation. That is 24% below current levels and would qualify for a crash.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 Crash back in late 2007? We did, and our clients made triple digit returns when the markets imploded.

We’re currently preparing for a similar situation today.

Indeed, I’ve already alerted subscribers of my Private Wealth Advisory newsletter to two plays that resulted in gains of 11% and 41% in just six week’s time from the market’s volatility.

This is nothing new for us, in the last 17 we’ve closed out 77 straight winning trades.

Did I say, “77 straight”winning trades”?!?

Yes, I did.

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%...

And I’ve got three more winners (#’s 78, 79, and 80) on deck as I write this.

But more importantly, throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

77 closed winners… and not one closed loser… in 17 months.

Based on what’s happening in the markets today, we’ve decided to extend our deadline on our current offer to try Private Wealth Advisory by another 24 hours.

So tonight (Monday) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit