Futures are looking weak again.

Traders gunned for 2,100 on the S&P 500 last week. They briefly touched that level, but there was no follow through for the obvious reason: no one with a brain believes this rally.

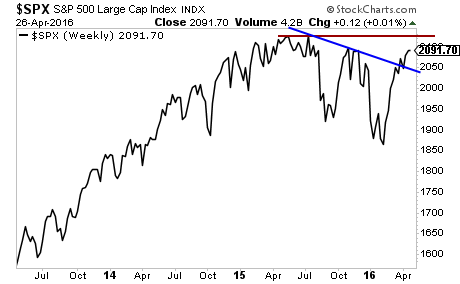

We’ve broken above the downward trendline established by a series of lower highs in 2015. However, there’s a decent space between here and the all-time highs that has yet to be filled. And with momentum waning, it’s quite possible this move was a false breakout.

In truth it’s difficult to find just who is buying stocks right now. Corporate buybacks are in a blackout period, so it’s not that. Corporate insiders are selling the farm. Individual investors are pulling money out of stock funds. And institutional investors have been net sellers of stocks for weeks now.

This leaves Central Banks.

What used to be conspiracy theory is now a fact: the futures exchanges permit Central Banks to buy stock futures to provide “liquidity.” It is not coincidence that this policy occurred around the time the markets began to feel increasingly manipulated with stocks ramping higher for absolutely no reason at various points during the day.

If this whole mess sounds like a recipe for a Crash to you, you’re correct. Markets require actual buyers to perform. Sure, Central Banks can manipulate stocks here and there, but you need real buy orders for a market to not completely implode.

Remember the Flash Crash? Remember 2008? Central Banks couldn’t stop those either.

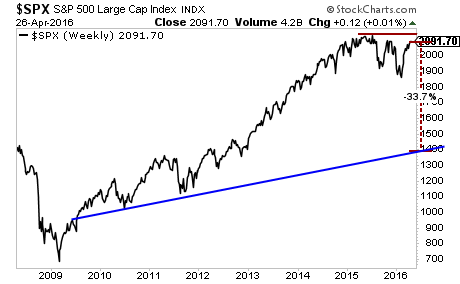

Take a look at the S&P 500’s long-term chart. Where does it look like it’s heading to you?

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 Crash back in late 2007? We did, and our clients made triple digit returns when the markets imploded.

We’re currently preparing for a similar situation today.

Indeed, I’ve already alerted subscribers of my Private Wealth Advisory newsletter to two plays that resulted in gains of 11% and 41% in just six week’s time from the market’s volatility.

This is nothing new for us, in the last 17 we’ve closed out 77 straight winning trades.

Did I say, “77 straight”winning trades”?!?

Yes, I did.

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%...

And I’ve got three more winners (#’s 78, 79, and 80) on deck as I write this.

But more importantly, throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

77 closed winners… and not one closed loser… in 17 months.

Based on what’s happening in the markets today, we’ve decided to extend our deadline on our current offer to try Private Wealth Advisory by another 24 hours.

So tonight (Wednesday) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit