So the world has woken up and realized what we’ve been pointing out for four years now… that Europe wasn’t fixed in 2012.

European Financials have fallen back to levels not seen since the Crisis was raging to the point that France and Germany floated the idea of imposing capital and border controls.

The whole mess was “saved” based on a lie. Mario Draghi claimed he’d do “whatever it takes… and believe me it will be enough” and the markets took him at his word.

Unfortunately the math doesn’t support this. The EU banking system is leveraged at 26 to 1. Many banks are leveraged far above this. Lehman was leveraged at 30 to 1 when it imploded. People laugh that somehow that was allowed to happen in 2007… without realizing that Europe’s entire €46 trillion banking system is just below that.

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 145% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER...

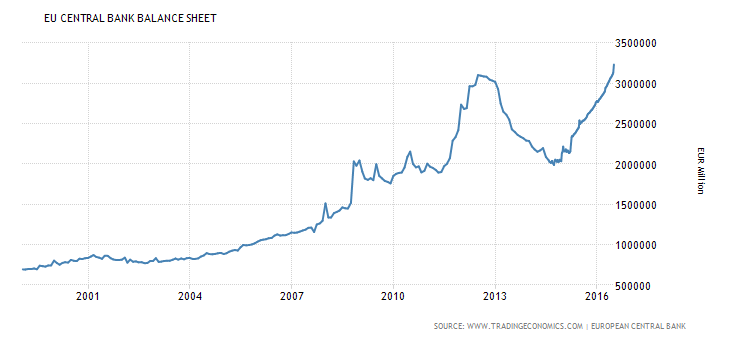

Since Draghi “saved” Europe in 2012, he’s cut interest rates to negative FOUR times and has implemented over €1 trillion in QE expanding the ECB’s balance sheet well above its previous record high set at the depth of the crisis.

Meanwhile, EU GDP has remained below its pre-crisis highs (both 2008 and 2011).

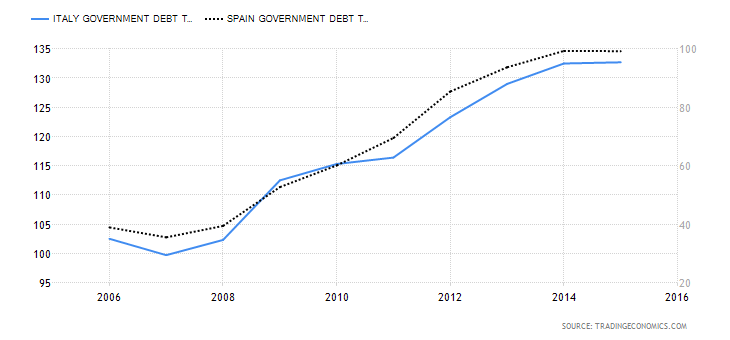

Meanwhile, Debt to GDP has risen to 90% for the whole of the union, with problem countries like Italy and Spain seeing their Debt to GDP ratios soar to new record highs.

The whole mess is one giant house of cards. Bankrupt nations whose debt is owned by insolvent banks which use said debt to backstop trillions of Euros worth of derivatives trades.

If Lehman was an obvious disaster waiting to happen what are the EU banks? And with the ECB itself now leveraged at over 36 to 1… who’s going to bailout this mess out?

More and more the financial system feels like it did in late 2007/ early 2008: the obvious cracks have emerged, but 99% of investors are ignoring them.

Smart investors, however, are preparing for what’s to come.

If you are not preparing for a bear market in stocks, you NEED to do so NOW.

I can show you how.

To wit… in the last 19 months we’ve closed out 96 straight winning trades.

That’s correct…

For 19 months, not only have Private Wealth Advisory subscribers locked in 96 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%...

But more importantly, throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

96 closed winners… and not one closed loser… in 19 months.

Based on what’s happening in the markets today, we’ve decided to extend our deadline on our current offer to try Private Wealth Advisory by another 24 hours.

So tonight (FRIDAY) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings,

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research