For years, I’ve been warning that all claims of economic “recovery” in the US are complete fiction.

We now have definitive proof in the form of tax receipts.

Receipts from the Federal Unemployment Tax Act (FUTA) have been falling steadily since 2012, according to the Office of Management and Budget, moving counter to the growing number of people employed. The FUTA tax is levied at 6 percent on the first $7,000 of an employee’s wage…

Source: CNBC

There you have it. Since 2012, unemployment tax receipts have been FALLING. If the US economy was indeed creating jobs, this number should be rising.

Why is this number falling… particularly when the unemployment number is supposedly below 5% and job growth is great?

There are a couple of answers to that question and neither is favorable. The BLS numbers are either wrong or the quality of new jobs created must be very poor. The latter response seems the most credible; a combination of an increase in the proportion of part-time workers and full-time jobs that provide lower compensation.

Source: CNBC

As I’ve been saying for years… the recovery narrative is a myth.The unemployment number has become a political propaganda tool and has no reflection on the US’ economic realities.

———————————————————————–

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 37% return on invested capital thus far in 2016.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 240% thus far in 2016.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

———————————————————————–

In simple terms, job growth has NOT come back in the US. Those jobs that are being created are low paying.

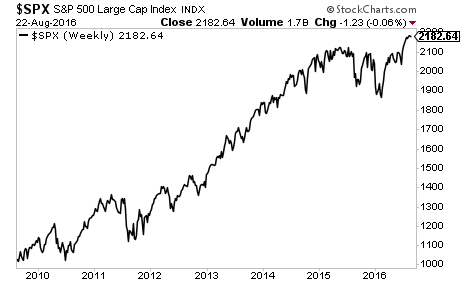

Meanwhile, the stock market is at al -time highs…

On that note, we firmly believe the markets are preparing to enter another Crisis. With over 30% of global bonds posting negative yields, the financial system is a powder keg ready to blow. And as usual, the Central Banks are clueless about the risks.

If you’re looking for investment strategies to profit from this, I can help you…

Because I am usually warning about risks in the market, everyone assumes I’m nothing but a bear who has his clients shorting the heck out of the market all the time.

Pointing out the risks to the stock market is very different from actively shorting it. The editorial I publish here is focused on alerting EVERYONE about the problems the financial system faces.

However, when it comes to active investment strategies… I do see opportunities to short… but I also see opportunities to go long.

Case in point, thus far in 2016 Private Wealth Advisory subscribers have made a killing shorting European banks while also being long various mining companies.

As a result of this, we’re now at 98 STRAIGHT WINNING TRADES.

Indeed, we haven’t closed a single loser since November 2014.

98 straight winners… and not one closed loser… in 20 months.

We take a careful and calculated approach to investing… which is how we’ve been able to maintain this incredible streak of winners… despite market conditions that can be described as “challenging” at best.

You can join us today by taking out a 30 day trial subscription to Private Wealth Advisory for just $0.98.

If you find Private Wealth Advisory is not what you’re looking for just drop us a line and you won’t be charged another cent.

To take out a 30 day trial subscription to Private Wealth Advisory for just $0.98…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research