The head of HSBC’s Technical Analysis group just issued a major warning.

Unless the markets can take out its September highs, we could very well see a repeated of the 1987 Crash.

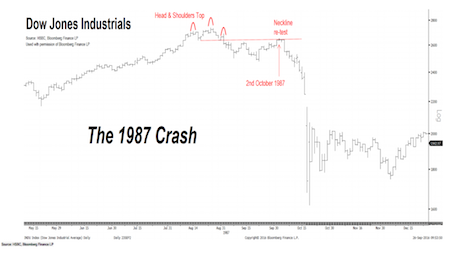

Murray Gunn is head of technical analysis for HSBC. In a recent client note, he pointed out the Head and Shoulders top pattern that presaged the 1987 Crash.

In its simplest forms, the Dow Jones Industrial Average formed a Head and Shoulders top when it violated its neckline. We then had a failed attempt to reclaim the neckline, which resulted in the Crash.

———————————————————————–

The Single Best Options Trading Service on the Planet

Yesterday, while 99% of traders were getting killed we locked in THREE new double digit winners.

As a result of this, our options trading newsletter, THE CRISIS TRADER has now produced an astounding 270% return on invested capital thus far in 2016.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 124% thus far in 2016.

You can try this service for 30 days for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

———————————————————————–

Gunn notes that the Dow is forming a similar pattern today. He also notes that momentum is waning, and Elliot Wave analysis indicates a 1987-Crash could indeed occur.

A big move is coming to the markets. And we’re already preparing for it.

Indeed Private Wealth Advisory subscribers just locked in another two winning trades bringing us to 112 STRAIGHT WINNING TRADES.

Indeed, we haven’t closed a single loser since November 2014.

112 straight winners… and not one closed loser… in 22 months.

Subscribers are pouring into this newsletter, to get these kinds of gains.

However, I cannot maintain this kind of track record with thousands of investors following our recommendations.

So tonight (Wednesday) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… last call… NO MORE EXTENSIONS!

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research