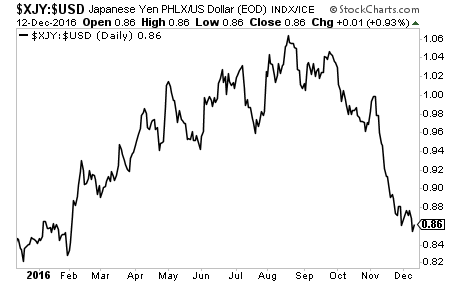

Just as we predicted, the Bank of Japan has begun to lose control.

Since the November US Presidential election, the Bank of Japan has been aggressively devaluing the Yen. They are doing this to take advantage of the brief window between the election and when Trump takes office and trade deals are renegotiated.

As I wrote previously, this scheme will work for a while, but eventually something will “break.”

It just did.

When the Yen collapses, the $USD rises sharply. And this is a MASSIVE problem for China which has its currency pegged to the $USD.

China is the second largest economy in the world. And every day that the $USD moves higher, it puts tremendous pressure on China’s financial system.

See the below story:

China’s foreign exchange reserves fell nearly $70bn last month as the country’s central bank burnt through more of its war chest in its battle to defend the renminbi from greater depreciation on the back of accelerating capital outflows.

Source: Financial Times

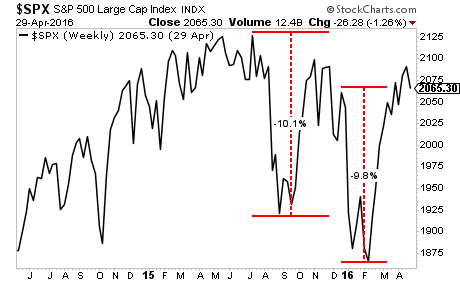

If you’ll recall, it was precisely this situation that caused the market meltdown of August 2015…and January 2016.

We’re set up for the another similar meltdown. Stocks are severely overbought. Everyone is super bullish. The markets are literally one giant lopsided trade waiting to implode.

THIS WILL HIT BEFORE THE END OF JANUARY.

Another Crisis is brewing… the time to prepare is now.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Prepare and Profit From the Next Financial Crisis that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are fewer than 29 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/Prepare1.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research