The market has become one giant trade.

That trade is:

- Long US stocks

- Long the $USD

- Short Treasuries

- Short Gold

In terms of speculative positioning, as Hedgopia has noted hedge funds are net positioned in precisely these positions with the exception of Gold (net long 96.6 futures contracts).

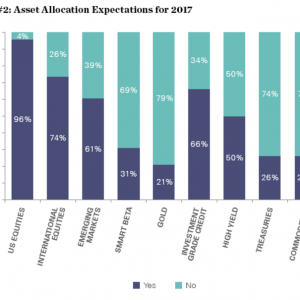

Moreover, investment advisors are piling their clients into precisely these positions.

H/T Josh Brown

So Hedge Funds and investment advisors are positioning their clients in precisely the same trades (except Gold). All we need now are individual investors to follow suit of their own volition and we’ve got one gigantic lopsided market.

Guess, what?

According to Trimtabs since the Presidential election on November 8th, individual investors have put $93 BILLION into stock-based ETFs.

This is more than 150% of the money investors put into those same ETFs during the ENTIRE year of 2015.

This kind of extreme buying is only seen during market tops. With investors now “all in” who is left to buy?

Stocks are already broadcasting what’s coming next.

Another Crisis is brewing… the time to prepare is now.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Prepare and Profit From the Next Financial Crisis that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are fewer than 19 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/Prepare1.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

For more of our research you can visit us at: http://gainspainscapital.com/