Yet another “unmassaged” data point has shown that the US economy is rolling over.

If you’ve been reading me for a while you know that one of my biggest pet peeves is the fact that headline US economic data (GDP growth, unemployment, inflation, etc.) is massaged to the point of being fiction.

For this reason, in order to get a real read on the economy, you have to look for economic metrics that are unpopular enough that the beancounters don’t bother adjusting them.

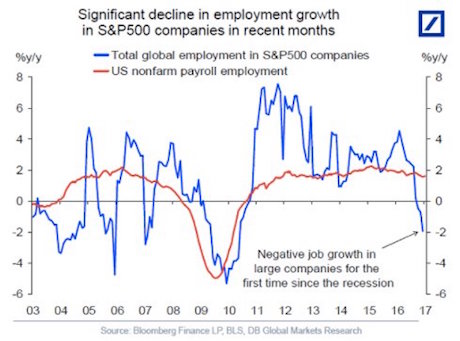

Case in point, look at the latest employment trend for S&P 500 companies (H/T Sam Ro).

For the first time since the Great Recession, employment growth has turned negative at S&P 500 companies. Also note the divergence between this metric and the headline unemployment rate.

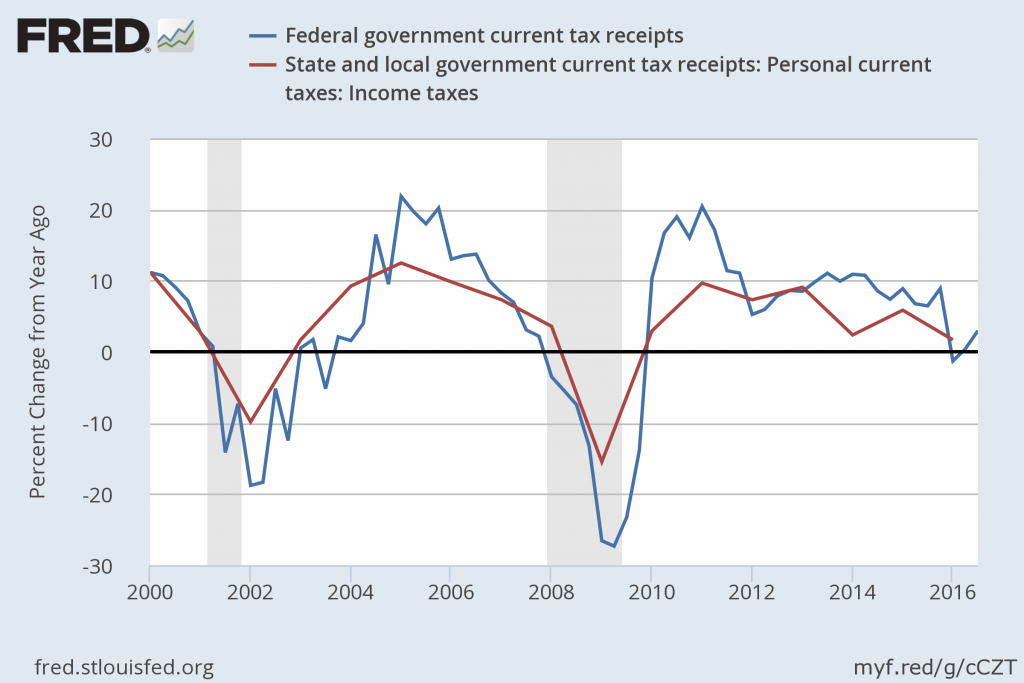

This is confirmed by tax receipts (another unmassaged data point). The argument here is simple: when employment is growing, more people are paying taxes and tax receipts rise. When employment is falling… tax receipts drop.

What is the above chart telling you?

The reality is that the “Trump trade” or the idea that the US economy is about to explode higher based on Trump taking office, is completely and utterly off-base.

At best any policies Trump implements will begin to have an effect 12 months from now. And those investors who are trading as though GDP growth of 5% is here now are about to get annihilated.

If you’re looking to profit from the REAL impact Trump’s Presidency will have on the market (and the massive opportunities this situation presents), we’ve put together a Special Investment Report outlining three investment strategies that will produce major returns as a result of Trump’s economic policies.

It’s titled How to Profit From the Trump Trade and we are giving away just 1,000 copies for free.

To pick up your copy, swing by

http://phoenixcapitalmarketing.com/trump.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research