The simplest outline for this week concerns inflation.

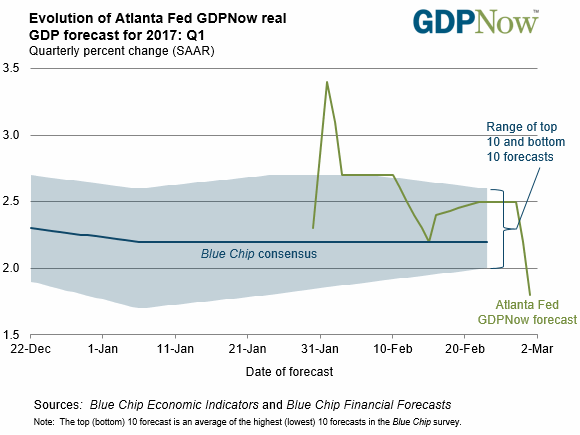

Stocks have erupted higher in the last month based on the belief that the economy is roaring once again. However, this is all about sentiment, not reality. The Fed’s own real-time GDP tracking tools has collapsed from predicting growth of 3.5% in early February to just 1.9% last week.

While “growth” isn’t coming anytime soon… INFLATION is.

—————————————————————————

This Might Be the Single Best Trading Newsletter on the Planet

Last year The Crisis Trader produced a return of 19%… nearly DOUBLE the S&P 500.

This comes on the heels of our incredible 63% return in 2015.

Traders are pouring into this newsletter, hungry for these gains.

But we cannot maintain this track record with thousands following these trades.

So tonight at midnight we’re raising the price of an annual subscription from $499 to $799

To lock in one of the remaining $499 slots before we run out.

CLICK HERE NOW!!!

—————————————————————————–

Globally, inflation metrics are going through the roof. In the US, inflation is now well above the Fed’s target rate of 2%. If you were looking at this chart as if it were a stock, you’d say that was a seriously bullish breakout.

The story is the same in Europe as well, where inflation is staging a bullish breakout to the upside. Two years ago, the EU was in a deflationary nightmare. Today, inflation is roaring having risen 3.5% in the last 18 months.

Inflation has even appeared in Japan for the first time in years.

THIS, not growth, is the big story for 2017: after maintaining interest rates at ZERO if not negative for 7 years, and printing over $14 trillion, Central Banks have unleashed an inflationary tsunami.

Those who invest appropriately will make literal fortunes from this trend.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Heck earlier this week, we just closed out an 18% winner last week.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Chief Market Strategist

Phoenix Capital Research