Yesterday’s article caused quite a stir.

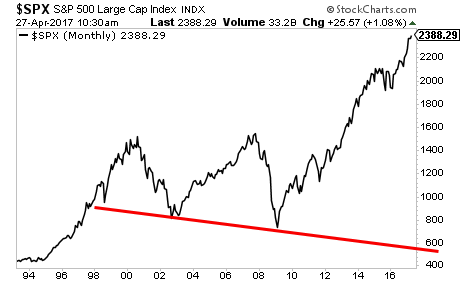

The basic premise is that when you value the stock market based on objective metrics that cannot be fudged, it’s more overpriced than it was at the 2007 peak and is rapidly approaching the 1999 peak.

However, the underlying reason that stocks are so ridiculously overpriced has to do with another asset class: bonds.

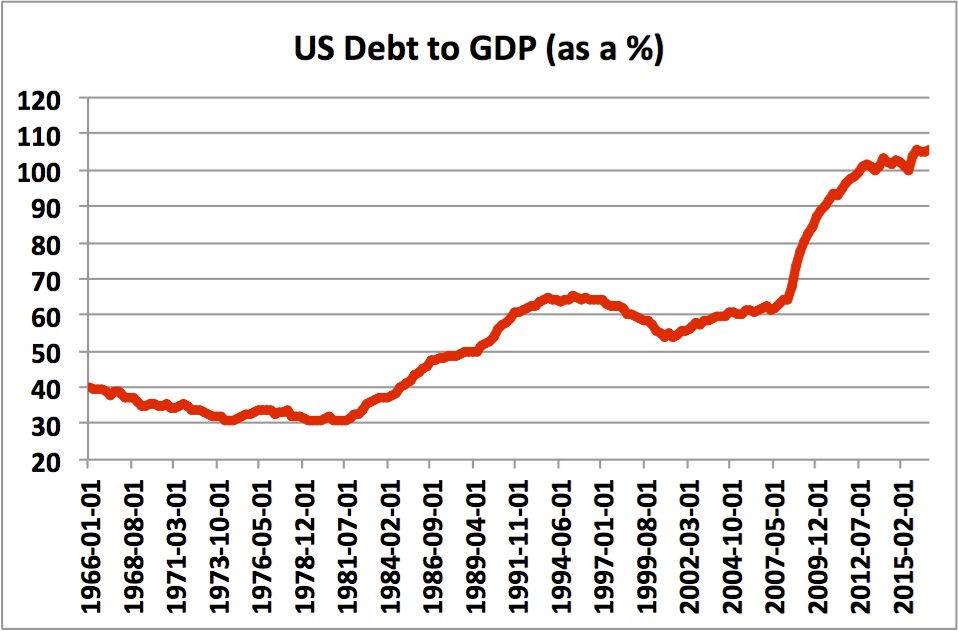

The fact is that by keeping interest rates at zero for seven years, the Fed has created a bubble in bonds. Back in 2008, the US’s Debt to GDP was just 65%.

Thanks to seven years of ZIRP, the US Government was able to go on a massive spending spree, ballooning the Debt to GDP to above 105% where it sits today.

How does this impact stocks?

According to the Fed Model for valuing assets, stock prices trade based on interest rates (bond yields).

The equation is the following:

(Stock Earnings/ Stock Prices)= 10 Year Treasury Yields.

So… if yields are pushed to record lows courtesy of Fed policy… and earnings are not growing rapidly to make up the difference, stock prices must soar.

If this sounds like a load of nonsense to you, it is in fact the primary argument the financial elites are making for why stocks are such a bargain even today.

“Measured against interest rates, stocks actually are on the cheap side compared to historic valuations,”

~Warren Buffett in an interview with CNBC February 2017.

Buffett is indirectly revealing the Fed’s whole game here: drive yields down so that stocks will rally. Indeed,this was the entire point of Fed activity post-2008: to reflate another bubble (this time in bonds) forcing capital into the financial markets.

So in this sense, stocks are in fact in a derivative bubble… a bubble that is derived from another bubble (this one in bonds). And it will end as all bubbles do: in disaster.

The below chart isn’t a pretty one, but it’s worth keeping in mind as stocks move ever higher into nosebleed territory.

To pick up a FREE investment report outlining three investments that you could make you a ton of money when this bubble bursts…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research