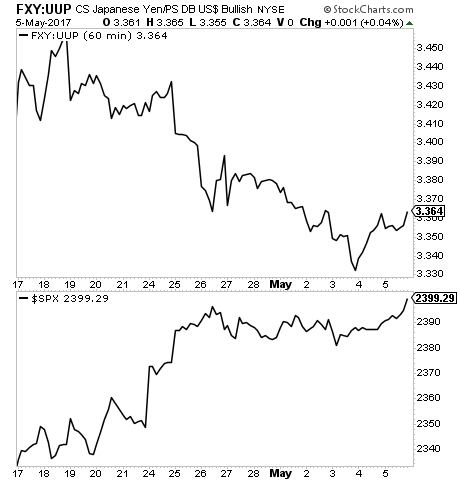

The Bank of Japan is once again pushing deflation into the financial system by aggressively devaluing the Yen against the $USD.

This is the famed Yen carry trade. And it is being done to rig stocks.

You can see the CLEAR inverse relationship between the two in the chart below, with virtually every down-tick in the Yen/$USD pair matching an UP-tick in the S&P 500.

The problem with this is that when the Yen drops hard against the $USD, it exports deflation in the financial system.

And there’s only so much the system can take until “something” breaks.

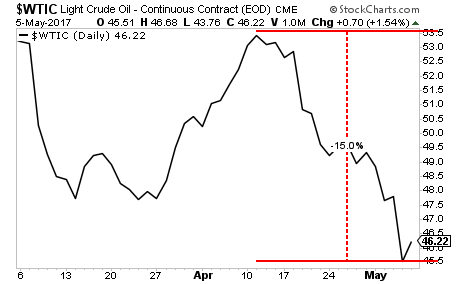

Last month, that “something” was Oil. The commodity has dropped an incredible 15% in roughly three weeks thanks to the Bank of Japan’s meddling.

This is a preview of what’s coming to stocks.

Stocks LOVE market rigs in the short-term. But those same rigs always end HORRIBLY down the road. And given how overbought stocks are, the potential for a sharp 15% drop similar to that which Oil just staged could very well hit stocks soon.

A Crash is coming… it’s going to horrific.

And smart investors will use it to make literal fortunes from it.

To pick up a FREE investment report outlining three investments that you could make you a ton of money when the markets collapse…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research