More and more signs of inflation are showing up.

In the latest ISM reading (a measure of economic activity in the US), this following tidbit showed up:

- Factory index climbed to 60.8 (est. 58.1), the highest since May 2004, from 58.8; readings above 50 indicate expansion

- Measure of new orders increased to 64.6, the strongest since February, from 60.3

- Employment gauge rose to 60.3, the best reading in more than six years, from 59.9

- Index of prices paid advanced to 71.5, the highest since May 2011, from 62

Source: Bloomberg

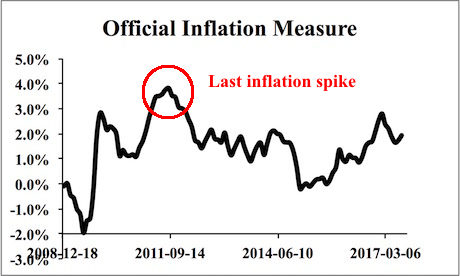

Put simply, the US economy is moving sharply forward with significant growth… and much HIGHER prices being paid. The reference to year 2011 is particularly relevant as that marked the last major inflationary spike in the US.

—————————————————————-

Are You Ready For the Next Crisis?

The markets are in a massive bubble. And when it bursts, it’s going to make smart traders very, very RICH.

Our specially designed options service The Crisis Trader is already up 37% this year, and that’s BEFORE the Crash hits.

Yes, 37%. And we’ve still got FOUR months to go this year!

Normally a service like this costs $5,000 just to try…

But you can get FOUR of The Crisis Trader’s high octane options trades for just $0.99 today.

This offer expires this Friday at midnight.

—————————————————————-

The $USD has already caught on to this, having dropped 10%. And the long-term chart is even uglier.

This is THE trend of the next six months. If you’re not taking steps to actively profit from this, it’s time to get a move on.

We published a Special Investment Report concerning a secret back-door play on Gold that gives you access to 25 million ounces of Gold that the market is currently valuing at just $273 per ounce.

The report is titled The Gold Mountain: How to Buy Gold at $273 Per Ounce

Today is the final day this report will be available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/goldmountain.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research