Stocks are about to wake up to the risk of “higher rates.”

As I outlined in my bestselling book, The Everything Bubble: The Endgame For Central Bank Policy, the entire stock market move from the 2009 bottom onwards was induced by the Federal Reserve creating a bubble in US sovereign bonds, also called Treasuries.

The idea here was that if the Fed could force bond prices high enough (resulting in extraordinarily low bond yields) investors would be forced to move into stocks to seek higher returns. This was the “There Is No Alternative” (TINA) theme that Wall Street pushed from 2010 onward.

And it’s about to crash into a wall.

The bond market has finally awoken from its slumber. And bond yields are starting to rise to accommodate the higher rate of inflation that is rippling through the financial system.

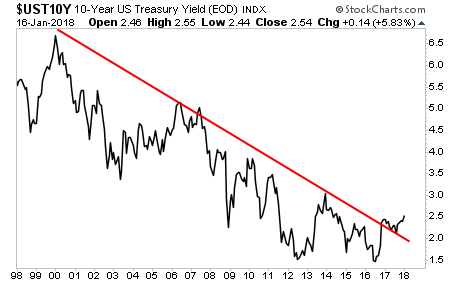

Indeed, the yield on the 10-Year US Treasury (the single most important bond in the world) has taken out its 20-year trendline.

Put simply, the bond market is warning that we are about to enter a “risk off” event in the financial system. And that “risk off” is going to be due to an inflationary shock that 99% of investors don’t see coming.

Put simply, the bond market is forecasting a SEVERE inflationary shock is coming shortly.

And it’s going to blow up the Everything Bubble.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research