If you want evidence of the Endgame for Central Bankers, you need to look no further than yesterday’s Bank of Japan (BoJ) announcement.

In its simplest rendering, Haruhiko Kuroda, the head of the BoJ, stated that the Japanese Yen is effectively worthless to him.

In his news conference, Kuroda reiterated that changes to the bond-buying operations don’t imply shifts to its policy stance, adding that the BOJ’s primary objective is the yield curve on Japanese government bonds, not the volume of its asset purchases. Kuroda also suggested the yen’s recent move may have resulted from broad dollar weakness, particularly against the euro.

Source: Bloomberg

Put another way, as far as the head of the BoJ is concerned… it doesn’t matter how much currency he prints: tens of billions of yen, hundreds of billions of yen, even trillions of yen… all that matters is where Japanese bond yields are trading.

This is the literal textbook for Central Bankers around the world: devalue your currency in order to maintain the bond bubble.

I outlined all of this in my best-selling book The Everything Bubble: the Endgame For Central Bank Policy... but I have to admit even I was stunned to see the head of a major Central Bank state this explicitly… and in public.

But let’s be clear… shredding your currency will work for a while… but eventually doing this unleashes inflation.

And that’s when we reach the End Game for Central Banks.

Why?

Bonds trade based on inflation.

If inflation rises, so do bond yields.

When bond yields Rise, bond prices FALL.

And when bond prices FALL, the massive debt bubble begins to burst.

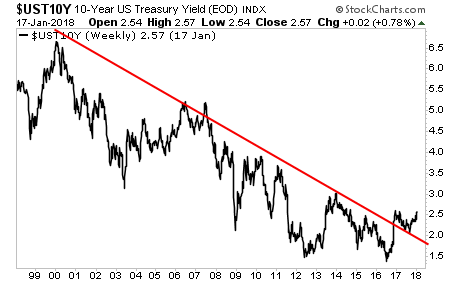

On that note, the yield on the most important bond in the world: the 10-Year Treasury, has already broken above its 20-year trendline.

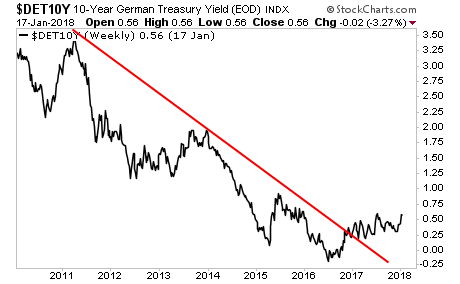

The US is not alone… the yield on 10-Year German Bunds has also broken its downtrend.

Even Japan’s sovereign bonds are coming into the “inflationary” cross-hairs with yields on the 10-Year Japanese Government Bond just beginning to break about their long-term downtrend.

Globally the world has added over $60 trillion in debt since 2007… and all of this was based on interest rates that were close to or even below ZERO.

All of this is at risk of blowing up courtesy of this spike inflation.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research