Inflation has become a big enough problem that even the Fed is talking about it.

By way of background, you need to understand that the entire game for the Fed is to dramatically understate inflation so it can continue to “paper over” declining living standards in the US.

Were the Fed to ever accurately measure inflation, it would quickly become apparent that incomes have failed to match increased costs of living in the US, and that the Fed is powerless to address the structural issues in the economy.

Put simple, one of the Fed’s primary roles is to dramatically understate inflation.

With that in mind, inflation has to become a serious problem for the Fed to start talking about it as a threat. Which is why the fact the Fed is upgrading its inflation forecast should be a wake up call.

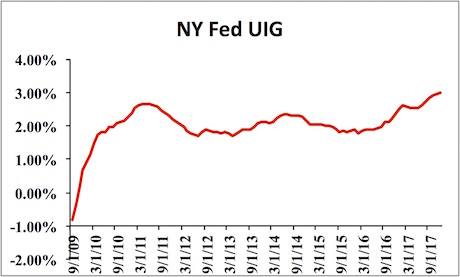

And why shouldn’t it? The NY Fed’s own inflation measure (the UIG) is clocking in at 2.98%, well above the Fed’s 2% target.

We are even getting signals of inflationary pressure moving into wages with total compensation rising 2.6% over the last 12 months.

Why does this matter?

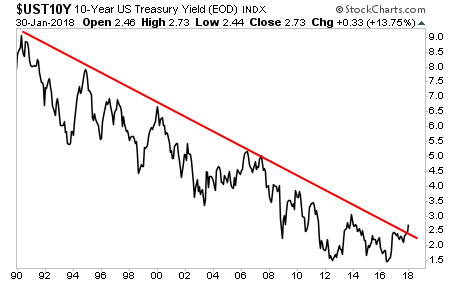

Bonds trade based on inflation.

If inflation rises, so do bond yields.

When bond yields RISE as they are right now, bond prices FALL.

And when bond prices FALL, the massive debt bubble begins to burst.

With that in mind, the yield on the 10-Year US Treasury has just taken out a 25 year trendline. This is the most important bond in the world, and it’s warning us that the debt markets are in serious trouble if the Fed doesn’t act soon.

Globally the world has added over $60 trillion in debt since 2009… and all of this was based on the assumption that bond yields were going LOWER not HIGHER

All of this is at risk of blowing up as rates continue to rise. The time to prepare for this is NOW before things blow up.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research