The economic data is now beginning to reveal what the bond market has been screaming for weeks: namely that INFLATION. HAS. ARRIVED.

In the last 24 hours we’ve seen:

- Core inflation rose 2.2% year over year for the month of February.

- Media one-year inflation expectations rose to 2.83% from 2.71%

- Wage data rose at an annualized pace of 3% over the last three months.

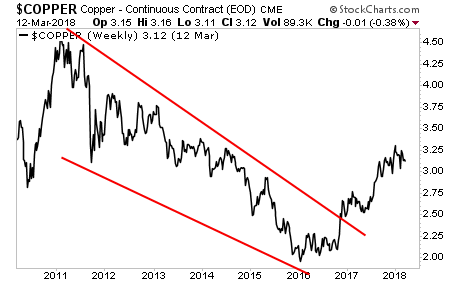

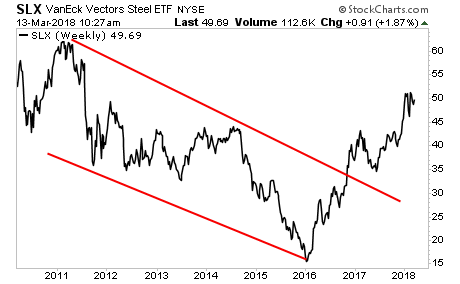

The markets have already taken note, with inflationary assets exploding out of downtrends and entering raging bull markets.

Copper is roaring higher.

Steel is doing the same.

Even Coal, which everyone thought was dead, is up 300% from its lows.

Unfortunately, this trend also spells DOOM for the Bond Bubble.

Why?

Bond yields trade based on inflation. So if inflation is rising, bond yields will do the same.

When bond yields rise, bond prices fall.

When bond price fall, the Bond Bubble begins to burst.

On that note, bond yields are spiking around to globe to accommodate higher inflation. Already we are seeing yields on US Treasuries, German Bunds, and even Japanese Government Bonds spike higher to test if not BREAK their long-term downward trendlines.

This is a truly global problem for global Central Banks which are all WAY behind the curve. And this is going to present investors with one of the great money-making opportunities of 2018 if they’re positioned correctly.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research