The following is an attempt to explain the Trump phenomenon. It is NOT a pro-Trump article; it is simply an explanation for how Trump accomplished what he did, and why so few predicted his success and the impact of his economic policies.

There’s a simple reason so few people in the media and in finance understand the economic impacts of a Trump Presidency.

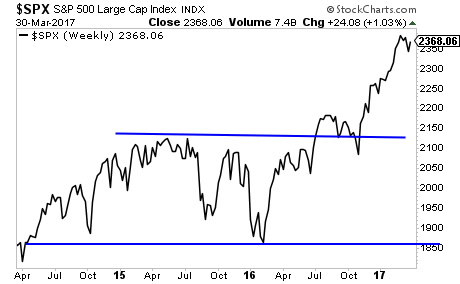

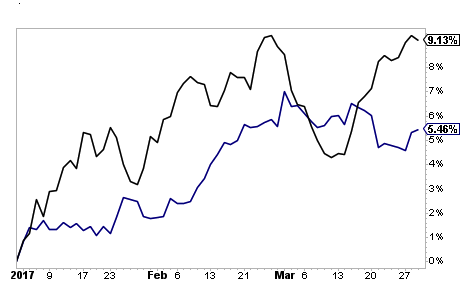

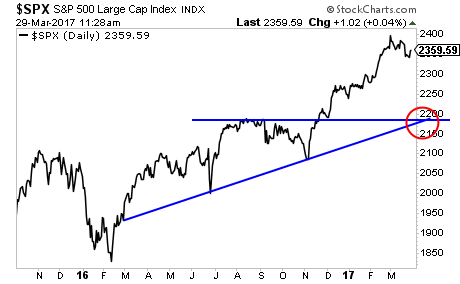

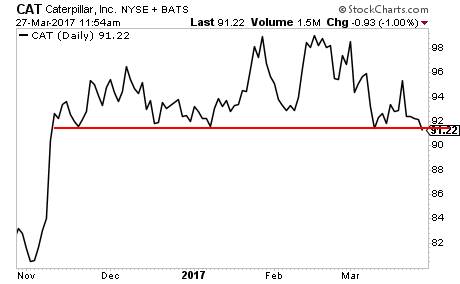

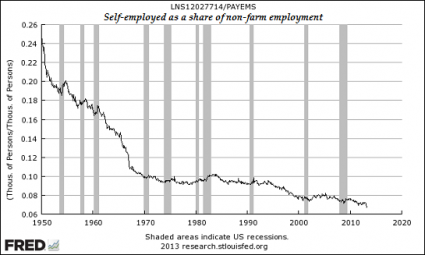

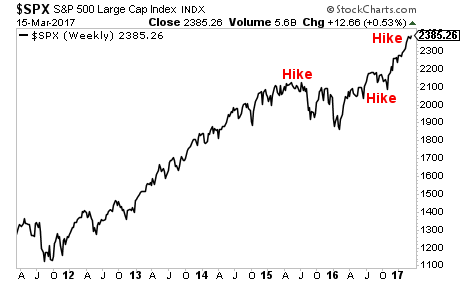

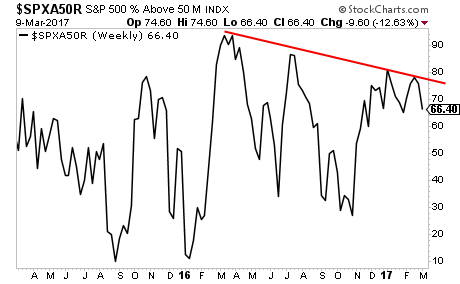

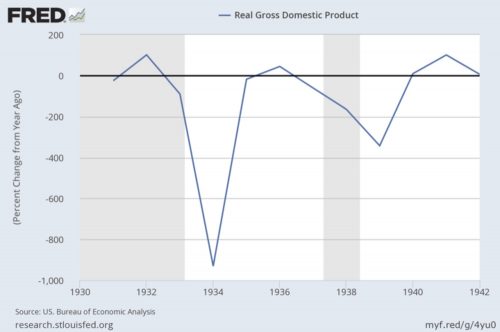

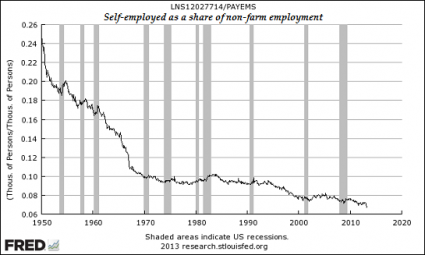

That reason is illustrated by this chart:

The percentage of people who are business owners relative to the overall employed population, is at an all time low.

The Fast Company, Shark Tank echo chamber would have you believe that entrepreneurialism is in a bubble.

It’s not.

Unprofitable, tech-centric gimmicks that are fueled by loosed monetary policies from the Fed are in a bubble. Legitimate businesses that produce cash flow and grow the middle class are not being created much, if at all.

Because the US has been waging war on the self-employed since the 1950’s, we not only have very few self-employed people in the workforce, we also have multiple generations of journalists who have ZERO experience engaging with those who run an actual business.

This is why NO ONE in the media gets Trump or the impact of his policies.

None of them have ever had to make payroll or create something from nothing. They’ve spent the last eight years literally kowtowing to a man who openly told the self-employed, “you didn’t build that.”

The same can be said for economists.

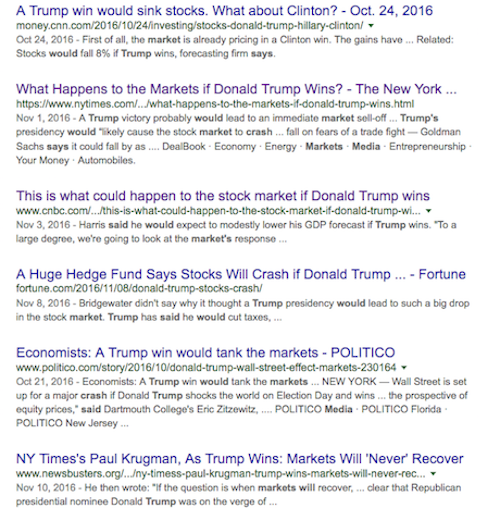

Time and again, you will see academics like Paul Krugman write op-eds suggesting that Trump is going to collapse the economy. Krugman has never once had to actually run a business. His entire career has been one of writing the equivalent of glorified book reports for other people who write glorified book reports to read.

If you ran a McDonalds or plumbing business implementing anything Krugman claims, you’d be broke within six months. The man lives in a world of excel spreadsheets and faculty meetings, not the world of revenues and payroll.

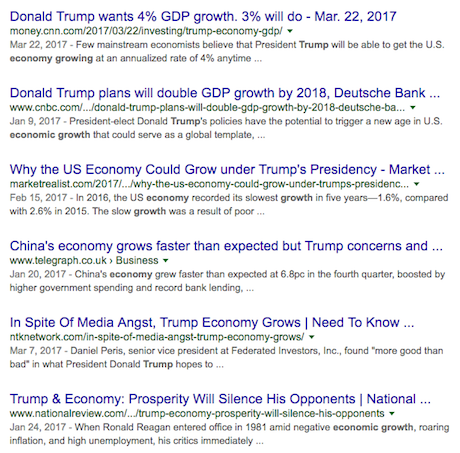

So what is Trump doing?

First off, Trump is getting rid of regulations.

Economists don’t understand the impact of this because none of their models include regulations. According to an economist, you simply “start a business.” These people have no concept of the business costs of licenses and the like.

Business owners care far more about regulations than taxes. Get ride of stifling regulations and you can start growing your business more aggressively.

I can tell you, business owners would happily pay more in taxes if they were doing 50% more in revenues. No business owner feels successful paying less in taxes on a business with zero growth.

Regarding taxes themselves, Trump understands them better than anyone in politics in the last 30 years.

Why?

Because as a business owner, Trump has been paying more taxes than the media or politicians can believe. This is why the obsession with Trump’s personal taxes is beyond moronic.

As a business owner, Trump has been paying taxes on property, payroll tax, taxes on some products, excise taxes, and a slew of others than journalists and economists don’t even know exist.

These people think taxes are something you pay on income.

For a business owner taxes are present in every single step of operations. And if you’re profitable, you then have to pay taxes on the money you’ve made.

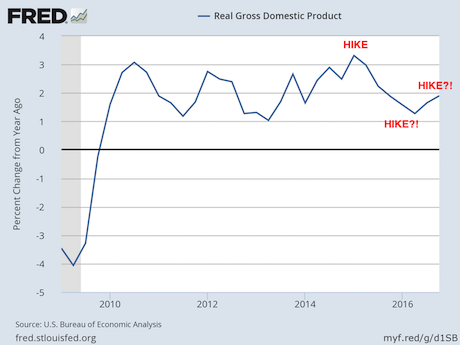

Finally, Trump is attempting to reform what is clearly a disastrous economic system.

The reality is that quality of life has been falling in the US since the ‘70s. This reality stares everyone in the face, but the chattering classes ignore it to tout “advances” like iPads and the like.

In the 1950s, one parent worked and people got along just fine. Today, two parents work and most people struggle to get by. There is no way to spin this as indicating quality of life has improved in the US.

The fact that the economic policies since 1971 have increased the number of billionaires doesn’t mean they (the policies) have been good for the US as a whole.

All these policies have done is dramatically increase the concentration of wealth, which in turn has allowed a small circle of people to exert an absurd influence on the US political and economic spheres (note that the media is now largely owned and managed by a group of billionaires).

All of the above contributed to Trump’s winning the US Presidency, taking out two political dynasties (the Bushes and Clintons), despite the efforts of a media that was literally colluding with Trump’s opponent.

That is reality whether you like it or not. The fact that many continue to see Trump through the lens of identity politics only shows how disconnected the media has become from realit. People want jobs and want to make a decent living. Once that is achieved, THEN they care about other items

No one in history has ever said, “well, I can’t get a job, there is zero upwards mobility for my future, and my kids are worse off than I am… but at least I know that [insert random identity politics cause] went well.”

Trump, whose entire career has been one gigantic effort to make himself wealthy gets this. People who have started and their own businesses get this. But it seems almost no one else does.

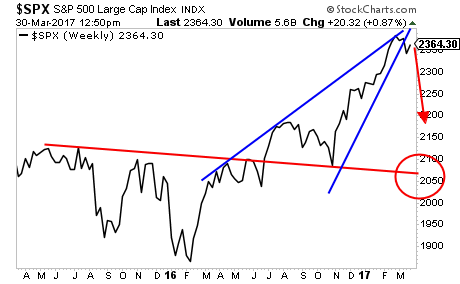

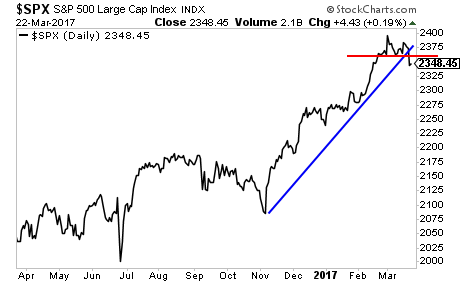

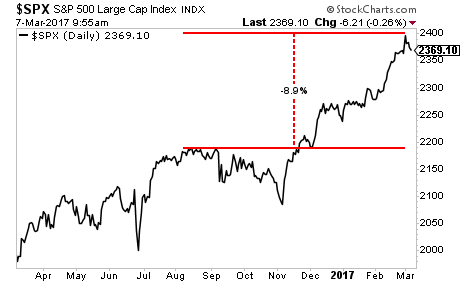

If you’re looking to profit from the REAL impact Trump’s Presidency will have on the market (and the opportunities this situation presents), we’ve put together a Special Investment Report outlining three investment strategies that could produce major returns as a result of Trump’s economic policies.

It’s titled How to Profit From the Trump Trade and we are giving away just 99 copies for free.

To pick up your copy, swing by

http://phoenixcapitalmarketing.com/trump.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research