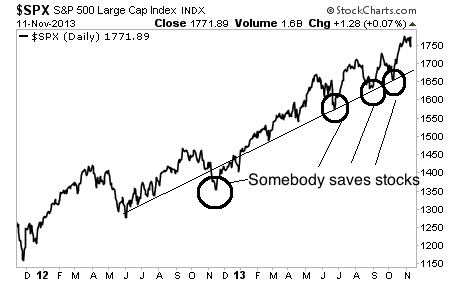

Last year was a blockbuster year for stocks, with the S&P 500 rising nearly 30%.

This was the single best year for stocks since 1997. We are literally back to “the good old days” for stocks.

However, a small group of investors saw a return that absolutely dwarfed this.

Indeed, if this groups of folks positively DEMOLISHED the S&P 500 for the year, with an incredible 194% RETURN ON INVESTED CAPITAL.

That is not a typo, nor is it based on some kind of cherry picking (pumping your winners and ignoring your losers). This group of folks nearly TRIPLED their money in 2013.

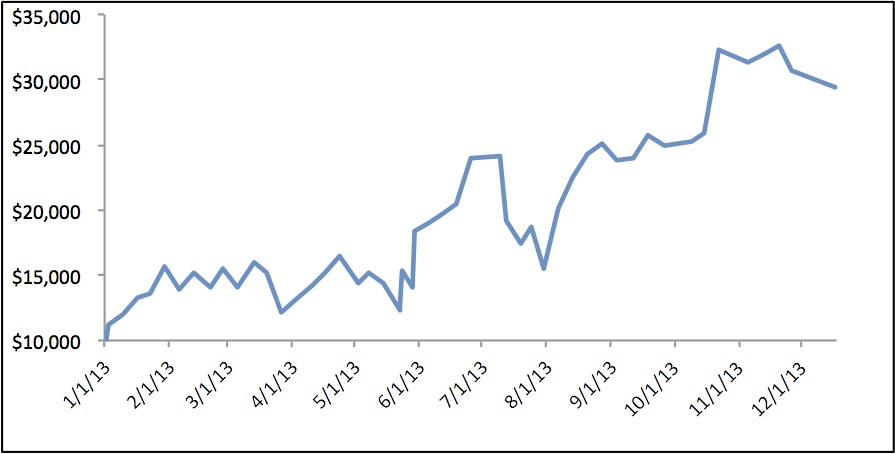

Indeed, using just $10K you could have grown your position into $29K using this ONE strategy.

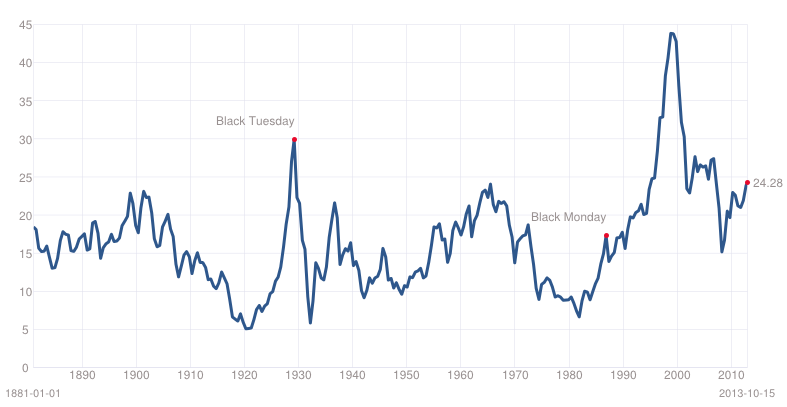

See for yourself:

And here’s the crazy part… these investors did it this by making JUST ONE TRADE PER WEEK.

I know that sounds absurd. Most people believe that to make money in the markets you need to trade all the time and trade everything under the sun.

Not these folks. They made… 194% GAIN with just ONE TRADE PER WEEK.

And they didn’t trade ANYTHING ELSE.

The groups of investors I’m talking about subscribe to options trading system called OPTIONS 1-1-1.

OPTIONS 1-1-1 is a unique and insanely profitable system for trading options.

It only makes ONE TRADE… On ONE OPTION… ONCE PER WEEK.

Hence the name, OPTIONS 1-1-1.

Don’t let the simplicity fool you… most traders who make money even 51% of the time are considered geniuses…

OPTIONS 1-1-1 makes money 70% of the time.

And because we keep our losers as small as possible, we end up CRUSHING the market AND 99% of investing legends.

Indeed, in 2013, we saw a 194% gain. But we’ve seen even better years than that. In 2011 we were up over 220%!!!

Here’s how it works…

Every Tuesday morning, OPTIONS 1-1-1 sends you an email and text alert identifying your weekly trade.

We pick out the option for you, tell you what price to pay, and how long we’ll be holding the trade for.

All you have to do is enter this information into your brokerage account.

Then, when it’s time to sell, we send you another text and email telling you to sell your position and what price to sell it at.

That’s it.

We’ve made our subscribers tens of thousands of dollars with this system. And we’re inviting you to join us now… before our next trade goes out on Tuesday. There’s already a better than 70% chance it will MAKE a MAJOR profit.

OPTIONS 1-1-1

One Trade… One Option… Once Per Week = BIG PROFITS.

To sign up now…

CLICK HERE!!!

Graham Summers

Editor

Options 1-1-1