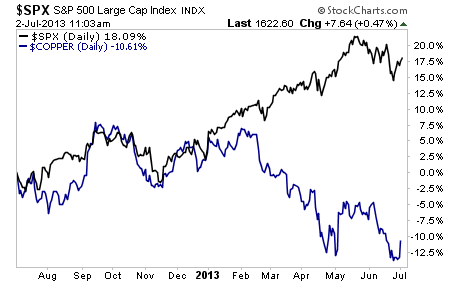

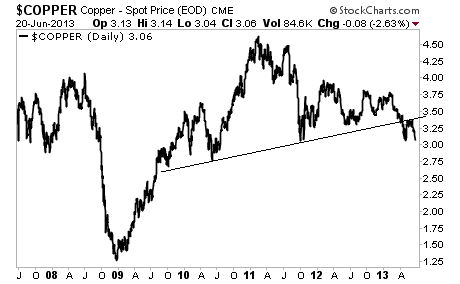

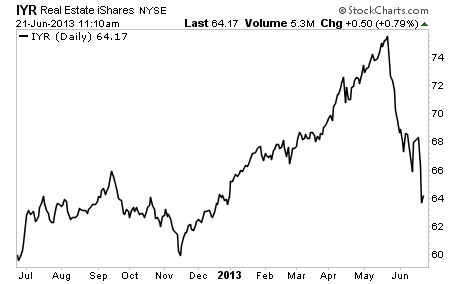

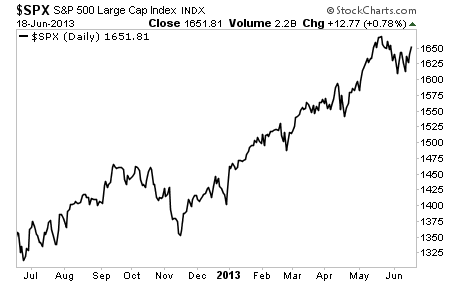

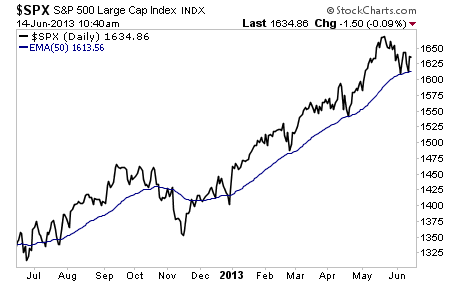

Well we got right to the trendline noted in earlier articles. We’re now beginning to roll over as we predicted.

The number of major problems hitting the system right now is truly staggering. Off the cuff I note:

1) Egypt falling into governmental collapse and a possible coup.

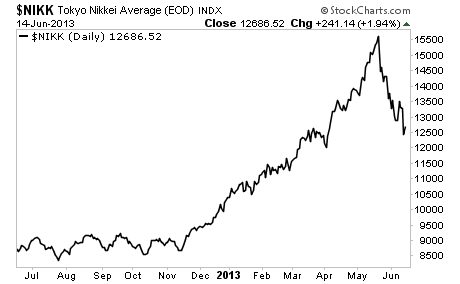

2) China entering a liquidity crisis.

3) Japan’s economy slowing despite record QE.

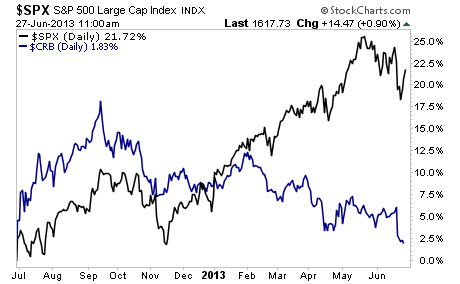

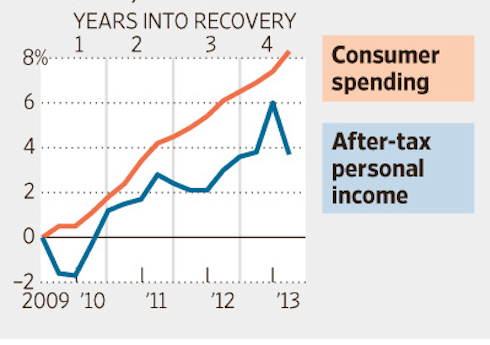

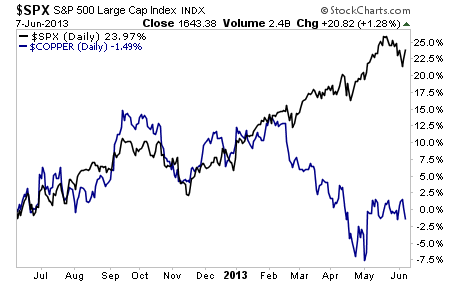

4) Multiple indicators flashing “recession” for the US.

5) Corporate profits falling.

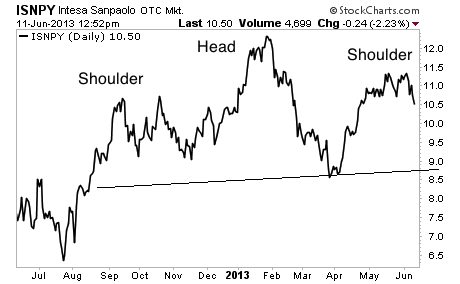

6) EU back in crisis mode with both Portugal and Greece facing another round of collapse (with Spain and Italy waiting in the wings).

And those are just the major headline grabbing issues. Those banking on the market rallying even harder have got a lot of obstacles to overcome.

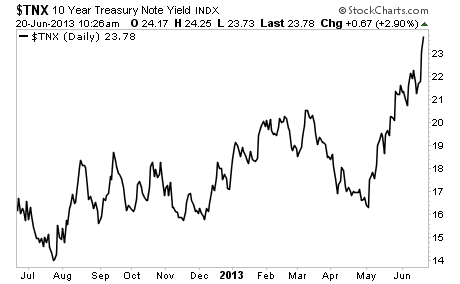

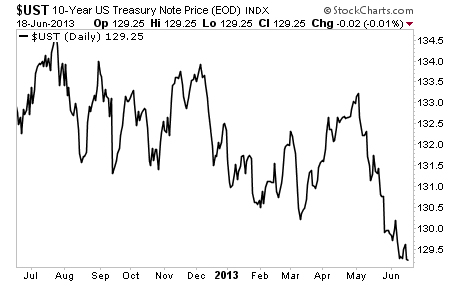

This is just the start. I warned Private Wealth Advisory subscribers in our most recent issue that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING. In fact we just closed another bringing our new winning streak to NINE trades.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… To join us…

Best Regards,

Graham Summers