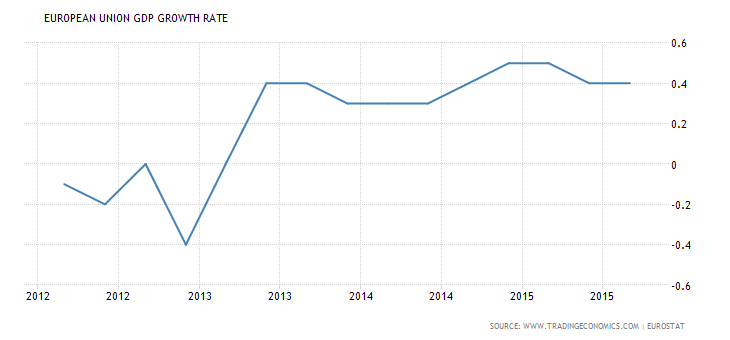

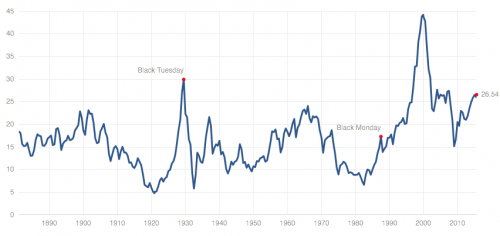

Last year we predicted that the world had reached peak centralization and that going forward things would begin to fracture.

What is centralization?

Centralization is the process by which the world grows increasingly centralized, relying on Centralized organizations (Central Banks, sovereign governments, etc.) to determine the direction of capital and focus.

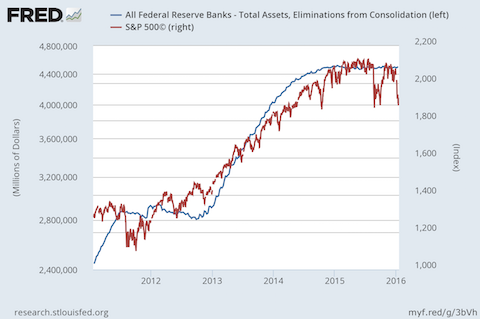

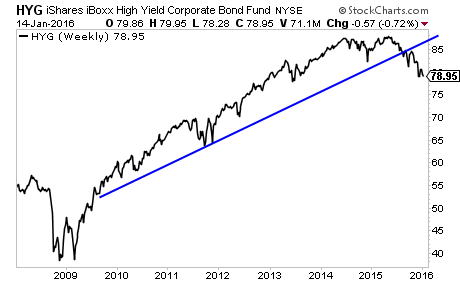

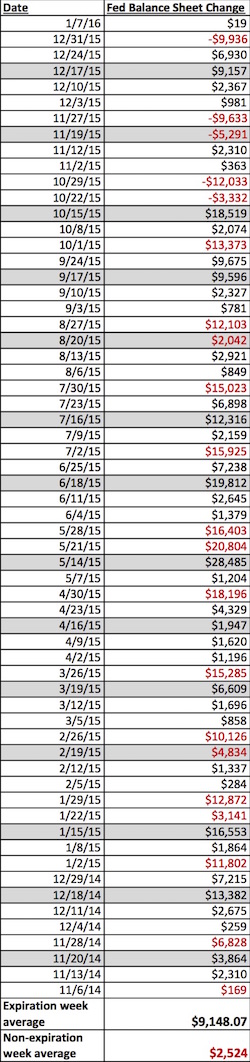

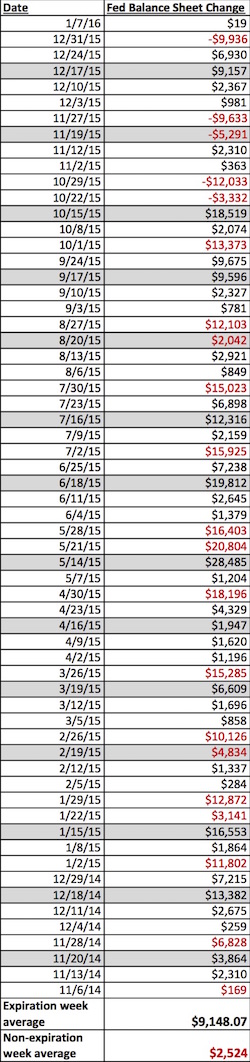

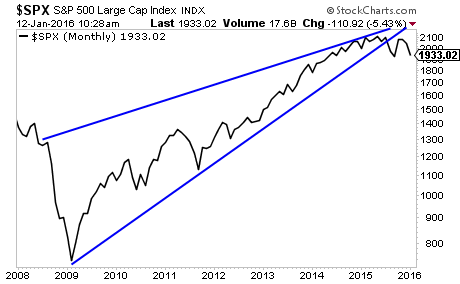

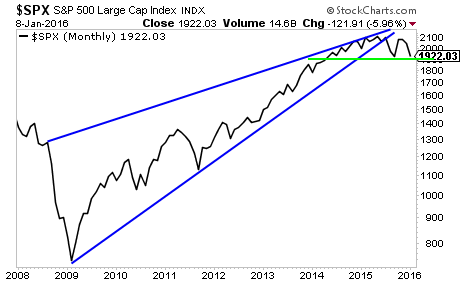

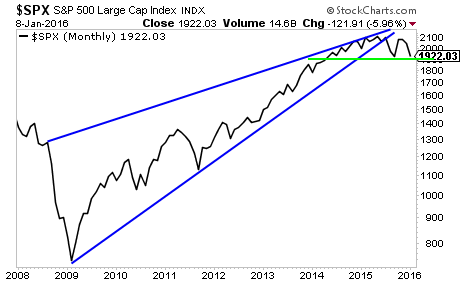

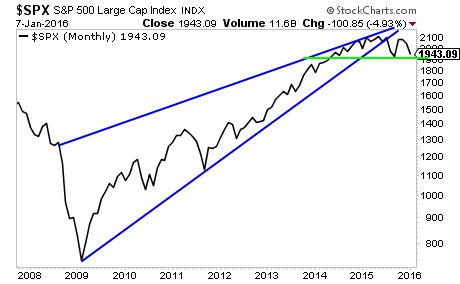

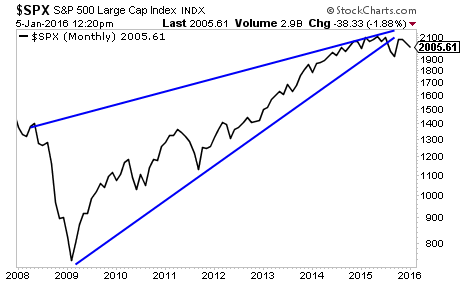

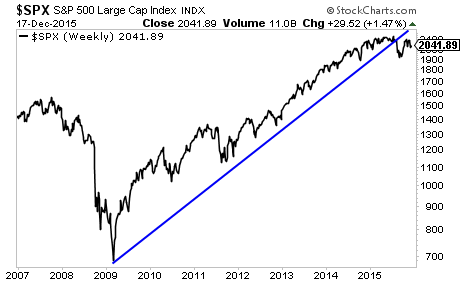

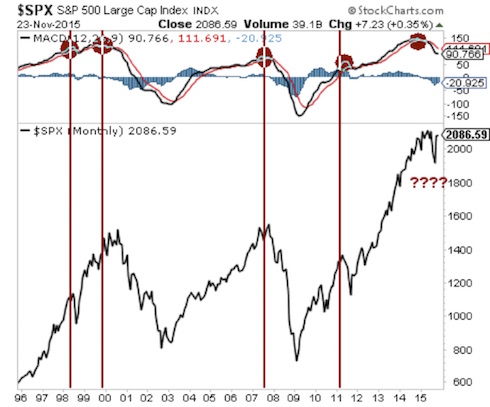

From an investment perspective, from 2008 to mid-2014, the primary driving force for the markets was Central Banks. In the US, the S&P 500 tracked the expansion of the Fed’s balance sheet closely.

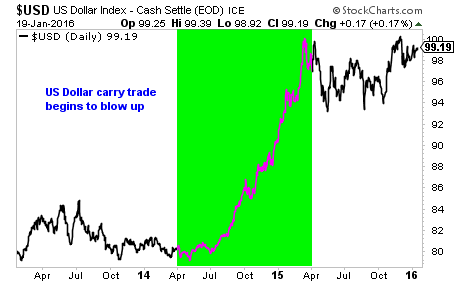

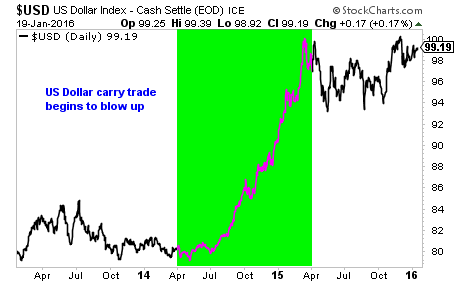

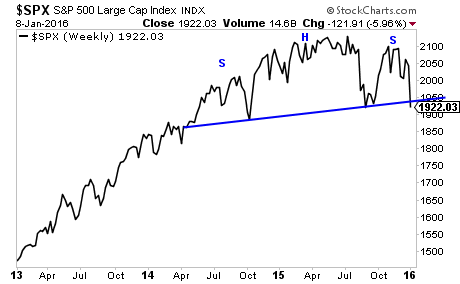

However, once the US Dollar carry trade began to blow up in mid-2014, this period ended. From that point onwards, the US Dollar was the driving force in the financial system.

How is this possible?

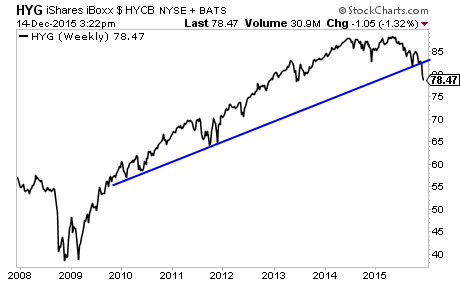

The US Dollar carry trade is $9 trillion in size. To put this in perspective, it is as large as the economies of Japan and Germany combined.

If you’re unfamiliar with the concept of a carry trade, it occurs when you borrow in one currency, usually at a very low interest rate, and then invest the money in another security, whether it be a bond, stock or what have you, that is denominated in another currency.

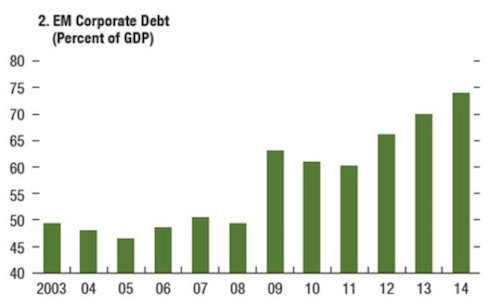

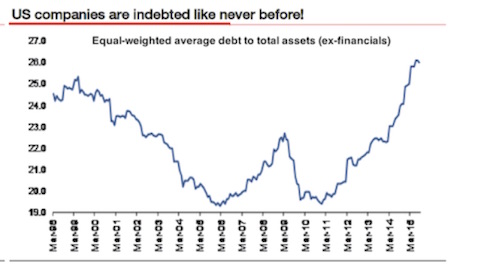

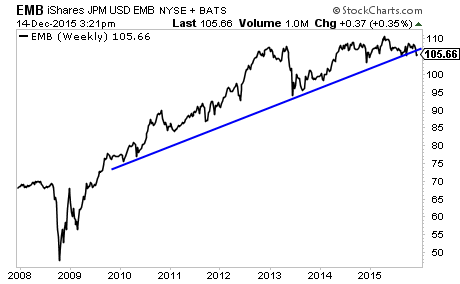

Everyone from currency traders to emerging market corporations were doing this from 2008 onwards. Emerging Market corporations alone have over $3 trillion in US Dollar dominated bonds outstanding. It those bonds were a country it would be the fifth largest in the world.

Now, a carry trade only works if the currency you borrow stays flat or falls in value. If the currency begins to rally, you blow up VERY quickly as the debt (the money you borrowed) quickly becomes more expensive or less serviceable.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we are up 35% year to date.

Over the same time period, the S&P 500 is 0%.

That’s correct, with minimal risk, we are outperforming the S&P 500 by 35%… and the year isn’t even over yet! Heck, we just closed out another 35% winner yesterday!

Our next goes out tomorrow morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

As a result of this, when a carry trade begins to blow up, a feedback loop quickly hits as those who borrowed in the original currency either A) default B) restructure or C) return the money, forcing the currency even higher which triggers more defaults, restructuring and margin calls.

This is why when the US Dollar began to rally in mid-2014, it went nearly vertical.

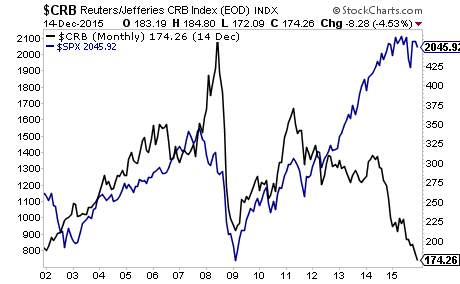

The first wave of the US Dollar carry trade blowing up crushed commodities and the emerging markets that rely on them for growth. I’m talking about Brazil, Russia, and the like.

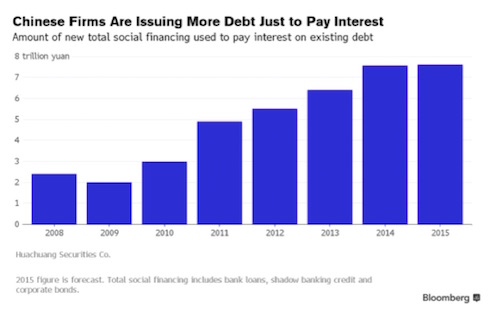

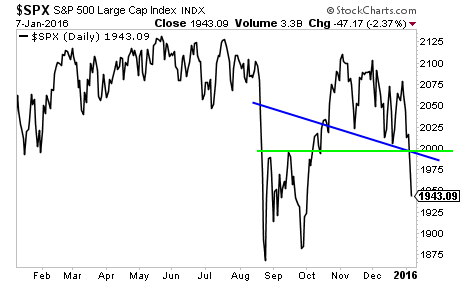

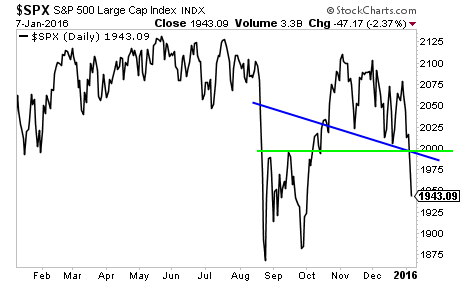

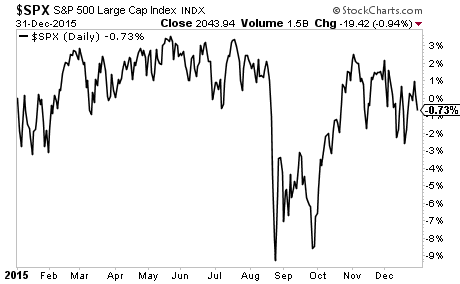

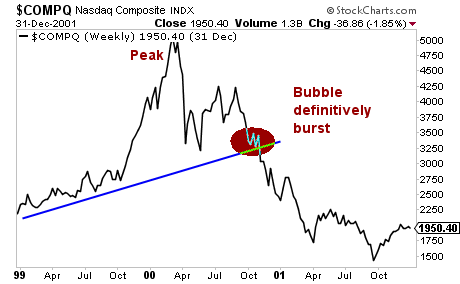

However, it is the second wave that will be even more damaging. That wave began last year in August when China was forced to devalue the Yuan against the US Dollar. At that point the US Dollar bull market was no longer forcing individual asset classes to collapse… it was imploding one of the largest economies on the planet.

This crisis has only just begun.

The 1997 Asian Crisis was triggered by Thailand devaluing the baht. Thailand’s economy is the 30th largest in the world. And it nearly blew up all of Asia.

China, by way of contrast, is either the second or third largest economy in the world depending on how you measure it. And it is now actively devaluing the Yuan. Just based on this alone, you can expect this crisis to be significantly larger than the 1997 Asian Crisis.

However, this is just China. Remember there are $9 trillion in US Dollars floating around in various carry trades. So China’s devaluation will be just the tip of the iceberg as every fiat currency in the world derives a portion of its value based on where the US Dollar trades. What’s happening in China will be rippling throughout the system taking down entire countries/ currencies/ and stock markets.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to make big money from the markets, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Over the last 14 months we’ve closed out 61 winning trades. That’s an average of more than FOUR winners per month.

And throughout this period, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS.

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research