Bill Gross, who manages the world’s largest bond fund, has indicated that the 30+ year old super cycle bull market in bonds has ended. This is very bad news for the markets.

First and foremost, if bonds fall, rates will increase. With higher rates, it will be harder to meet debt obligations. This will be the case for corporations as well as sovereign nations.

For the former, this means that more money going towards paying off debt and less going to shareholders. For the latter, sovereigns, this means default. Most sovereign nations in the developed world are sporting Debt to GDP ratios above 100%. These levels are just manageable with interest rates at record lows. When interest rates rise, default becomes a very real possibility.

In the case of the US, a 1% rise in interest rates means more than $100 billion more in interest payments. That money has to come from somewhere… which means either taxes going up, or the Government spending less on various programs.

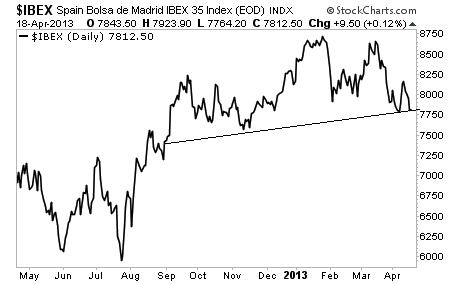

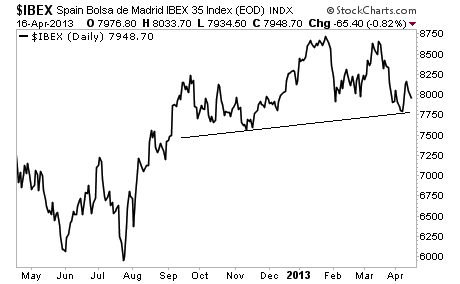

For Europe, a 1% rise in rates can be almost deadly. Italy and Spain were both thought to be rock solid members of the EU. Once their ten year rates rose to 7%, they were suddenly on the verge of default.

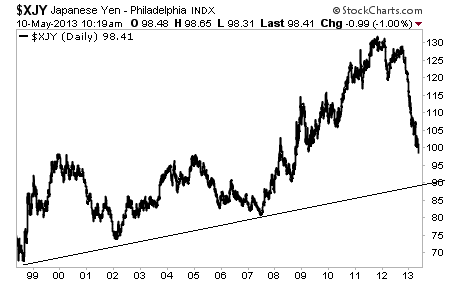

And for Japan, if rates rise just a few percentage points, the entire system collapses.

For investors trying to navigate this market, it’s critical to note that the last bear market in bonds ended over 31 years ago.

This means that there is an entire generation of investment professionals and money managers who have never invested during a bear market in bonds. So many of these folks will be in a totally new environment.

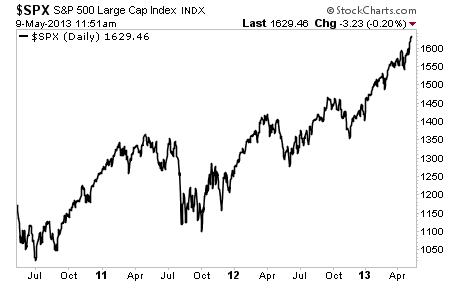

Investors, take note… stocks are always the last to “get it.” This bubble will end as all bubbles do: in disaster.

If you are not already preparing for a potential market collapse, now is the time to be doing so.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… having just seen another SIX trade winning streak…

To join us…

Best Regards,

Graham Summers