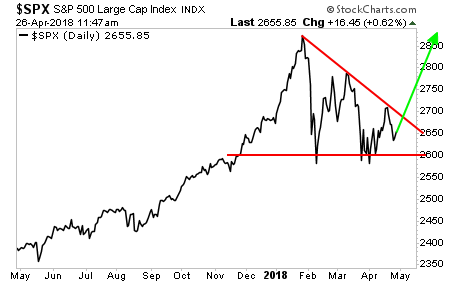

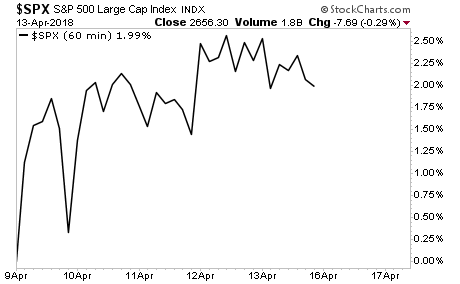

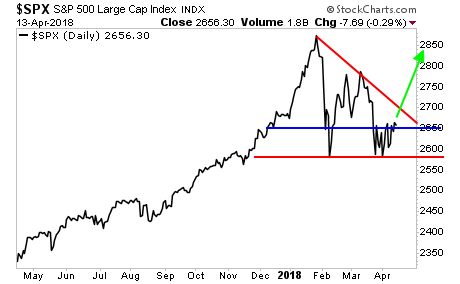

As I predicted three weeks ago, stocks have begun their move to new all-time highs.

The reason?

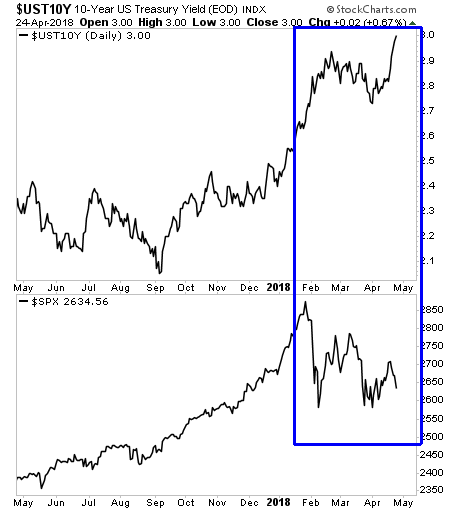

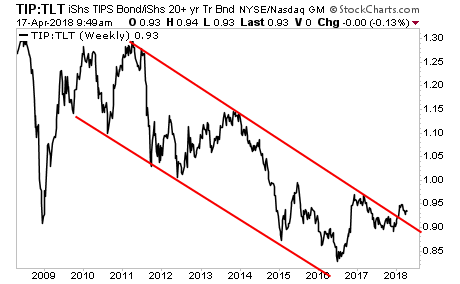

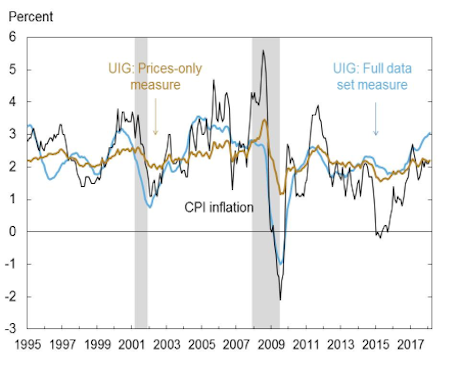

Inflation. Stocks LOVE inflation at first. But that relationship quickly goes sour once inflation results in rising operational costs that eat into profits.

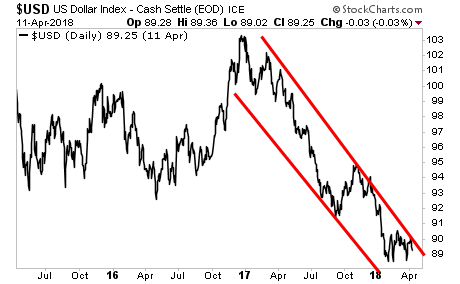

THAT stage is six-nine months from now. Right now, stocks are LOVING the weak $USD and inflationary backdrop.

This is the single biggest trend for 2018: INFLATION. And it could very well burst the Everything Bubble later in 2018.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research