I recently discovered that famed financial commentator, Mike “Mish” Shedlock published a piece in which he quoted an article I published and proceeded to tear my views (at least what he claims my views were) to pieces.

The actual article I wrote that Mish refers to is:

http://www.zerohedge.com/article/time-prepare-hyper-inflation-it-explodes

The first line of the piece notes that it’s a continuation of several other pieces I’d written before. Mish doesn’t bother referring to them anywhere. He simply starts off by quoting the following:

The similarities between the US today and Weimar pre-hyperinflation are striking. As in Weimar, US fiscal authorities are not taking any steps to rein in their loose money policies. Similarly, the US Fed, like Germany’s financial elites believes that currency depreciation is a good thing.

Thus we have a rather frightening set-up for hyperinflation in the US: the largest emerging market players are moving away from using the US Dollar at the same time that US monetary authorities are engaging in disastrous policies similar to those employed by the men who brought hyperinflation to Weimar Germany.

I firmly believe the US will see serious (‘70s style inflation) if not hyperinflation within the next 2-3 years. It could come sooner depending on how the Fed’s policies play out.

The purpose of these paragraphs was to say that the financial elite in the US are maintaining similar views to their counterparts in Weimar Germany. I DO NOT say the US is just like Weimar (though I say I believe we will experience similar hyperinflation at some point). I DO say that the financial elites in both countries engaged in similar practices. That’s a key difference.

Mish however, takes my quote to mean that Weimar and the US are identical in every way. He then lists four key differences between the two. His differences are:

1) Germany lost World War I

2) The Treaty of Versailles imposed repayment conditions on Germany that could not be met

3) To enforce the treaty, France occupied parts of Germany

4) Germany printed money so fast people burnt stacks of money for heat

On the surface these do indeed look like major differences (the US didn’t lose WWI, ISN’T forced by the Treaty of Versailles to make debt payments, isn’t being occupied by France, and has yet to print enough money that people burn bills for fuel).

However, these are only differences if one takes everything literally.

The US, like Weimar, is a massively indebted nation. And the US, like Weimar, is being forced to continue to issue debt and repay it (though in the US’s case it’s Wall Street and their lackeys in Washington pushing for this). Like Weimar, the US CANNOT repay its current debt obligations. And we’re also being taken down this road against our will (this time by Congress which ignores the fact most Americans don’t want us to issue more debt, similar to Weimar’s financial elite who continued down their path of loose money policies).

And finally the US Federal Reserve is printing money… like Weimar. Is it the exact same amount? No. Are people burning bills for fuel? No. But did I claim that the US was doing this? NO.

Again, the primary differences Mish lists between Weimar and the US are only differences if you take everything from a literal standpoint. And I wish to reiterate that Mish didn’t correctly get the primary points I was making in the sections he quotes. Of course that didn’t stop him from saying it was all “nonsense.”

Mish then takes issue with my suggestion that a common currency in Asia could potentially be a viable alternative to the US Dollar as the reserve currency of the world.

Mish quotes the following from my article:

Indeed, it was just revealed that ASEAN+3 countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam, China, Japan, and South Korea) are researching the prospect of a “common currency” similar to the Euro.

The significance of this development cannot be overstated.

Once again, Mish ignores other parts of the article in which I state that common currencies in general are flawed. He also ignores the fact that I never actually say a common currency from Asia is guaranteed. I DO say the following:

What I mean is that should a common currency be introduced in Asia, it would probably work for about 10-15 years. By then we’re well into the 2020s if not the 2030s at which point it is quite possible China will indeed be in a place to provide a world reserve currency on its own.

I wish to stress that even if Asia doesn’t implement a common currency and the US Dollar remains the world’s reserve currency (I put the odds of this at 20%), we are still facing a debt default in the US which will result in the US Dollar dropping dramatically in value and ushering in serious if not hyper-inflation.

The inclusion of “should” clearly illustrates that I am NOT saying a common currency is guaranteed in Asia but instead could be a potential option IF the respective Governments pursue it. Mish misses that point. But again, it didn’t stop him from calling my piece “nonsense.”

The rest of Mish’s piece consists of the same literal interpretation of everything I say. In the end, while trying to discredit my ideas while presenting himself as vastly more astute than me (to readers who likely didn’t even bother reading my article or the ones preceding it), all he really does is indicate that:

1) He doesn’t actually bother to understand what an author is saying before attacking his or her views

2) He has no issue calling others’ work nonsense without bothering to speak with the author or read additional material the author has put out

Regarding the latter point, I actual have spoken to Mish several times on the phone in the last few years. The most recent call was in July 2009. At that time I called to discuss the inflation/ deflation debate with him. Our debate consisted of Mish yelling for 15 minutes straight about how inflation didn’t exist and that anyone who believed it did was an idiot. I had to ask him to stop yelling several times so I could actually say something.

This is why Mish’s piece wasn’t totally a surprise for me. I’d already experienced his “no room for contrary views,” take on economics personally. And it’s not surprising that a man whose notion of a friendly discussion involves screaming over others would publish an article attacking someone else’s ideas without bothering to even figure out what the person is really trying to say.

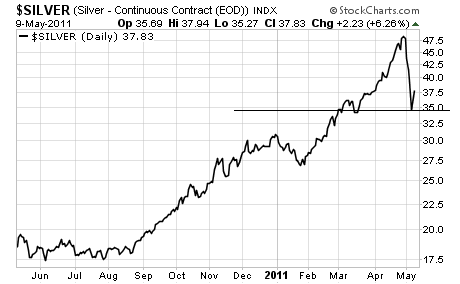

By the way, the time when Mish told me inflation didn’t exist and that I had to be insane to claim it was a reality was July 2009… when Gold was at $900 per ounce, Oil was at $70 per barrel, Wheat was under $600, and Copper was under $2.50.

However, I’m not going to personally attack Mish’s views or his writing because there are FOUR key differences between us:

1) I believe that writing a piece attacking someone’s ideas offers little if any value to readers or investors

2) I don’t actually read him much so I’m not familiar with his views… so even if I wanted to attack him, I wouldn’t feel comfortable doing so

3) Before attacking the ideas of someone who I’ve actually spoken to over the phone (several times), I would first write him a personal email asking him to clarify his points so I had a better grasp of what he was saying

4) I don’t consider views that are contrary to my own as “nonsense.”

Obviously none of these hindered Mish.

Graham Summers

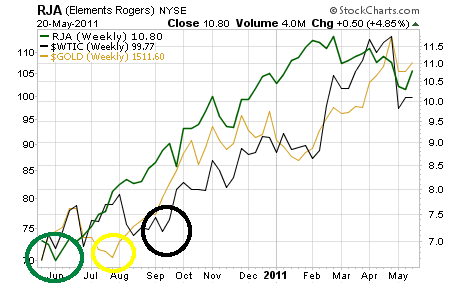

The technical pattern here is a falling wedge pattern. As the below chart shows we hit right up against upper descending trendline. We’re likely to test the lower trendline now which is around 72 or so:

The technical pattern here is a falling wedge pattern. As the below chart shows we hit right up against upper descending trendline. We’re likely to test the lower trendline now which is around 72 or so: If we do this, it will mean a test of the all-time low originally formed in July 2008. If we take this line out, we’re into uncharted territory.

If we do this, it will mean a test of the all-time low originally formed in July 2008. If we take this line out, we’re into uncharted territory. This situation needs to be watched closely as it could very well herald the next wave of inflation in the US. I’ve stated before I thought this latest US Dollar rally was a dead cat bounce. That’s now looking to be case.

This situation needs to be watched closely as it could very well herald the next wave of inflation in the US. I’ve stated before I thought this latest US Dollar rally was a dead cat bounce. That’s now looking to be case.