We’re introducing a new component to Gains Pains & Capital: an editorial focus on successful business practices and entrepreneurialism. Too much economic commentary focuses strictly on the markets… which, as we all know, is not the same thing as the economy.

So once a week, we’re going to be focusing on entrepreneurs, businesspeople, and artists from all walks of life who are using their talents to create high quality products and services that sell, potentially create jobs, and ultimately put the economy back on track.

This week we’re talking to Mark Courseille, head pastry chef at Michel, the newest restaurant to be opened by food legend and all around culinary genius Michel Richard (you’ll hear more about him in a week or two) in Tyson’s Corner Virginia.

I first met Courseille after my wife and I enjoyed one of the best meals of our lives at Michel. The highlight of the night was the “chicken” we had for dessert, one of Courseille’s signature dishes.

See for yourself.

This is a meringue, shaped like a hen, filled with luscious ice cream and sitting atop a nest of brittle sugar “straw,” whipped cream, and a pool of caramel syrup.

This is a meringue, shaped like a hen, filled with luscious ice cream and sitting atop a nest of brittle sugar “straw,” whipped cream, and a pool of caramel syrup.

The combination of textures and flavors was absolutely incredible. In each bite you had the sweet but brittle meringue combined with the soft, cold ice cream, as well as the caramel and sugar “nest.” Add to these unbelievable flavors the sheer fun of having “chicken” for dessert and this was hands down the most memorable dessert my wife and I have ever shared.

However, this was more than just a dessert, it was almost a marketing tool for the restaurant as a whole: as soon as our order came out, every table around us ordered one too. By the time we’d left I counted six others being served… all based solely on the appearance of our initial order.

Needless to say, Courseille had created something that was not only delicious, but an additional revenue stream for his employer (the “chicken” sells for $12, and to be honest, I would have paid $20 for it, it’s that good). Whether the guy knows it or not, he’s a marketing genius (on top of a master pastry chef). I had to meet him.

We recently sat down for coffee and talked desserts, the restaurant industry and more. The first thing I asked him was what inspired the “chicken” dessert.

“When people eat desert, they do it for pleasure, not out of hunger. So I try to create something that will make them happy, not just something that tastes great. I want my desserts to be fun, desserts that remind them of their childhood, something they will remember after they’ve left the restaurant and will tell their friends about.”

How do you do this?

“For me pastry is about presentation as much as it is about taste. If you are just going to go for taste, people will enjoy it, but it will not stand out in their minds. So for my desserts, I really try to be very precise and meticulous in the presentation. I try to make something people enjoy seeing as well as eating.”

But your desserts aren’t simply interesting to look at; they’re almost funny or playful. You make everything from Christmas Trees to Clowns.

“That is something I learned from Michel (Richard, 2007 James Beard winner for outstanding chef and owner of Michel where Courseille works). He was also a pastry chef before he became a chef. And he’s one of the masters of creativity in the kitchen. For instance, he designed a crème-caramel cheesecake. Normally when you eat American cheesecake, it’s heavy and leaves you very full.

So Michel combined a crème-caramel, a light French dessert, with cheesecake, a heavy American dessert, to make something that was both familiar and yet completely new. So when people ordered it, they get something that surprised them and made them laugh. It was not only delicious, but it created a very strong reaction for people so they remembered it. That’s the same impact I want my desserts to have.”

It’s also a unique hybrid of French and American cuisine. You’re combining two traditions into making something new.

It’s also a unique hybrid of French and American cuisine. You’re combining two traditions into making something new.

“Exactly. This is the future of pastry and the restaurant industry in general. People don’t want just traditional French or American pastry. They can get this anywhere. Instead, you have to merge those two cuisines or find some other unique approach to creating food that people cannot find anywhere else. You need to make yourself stand out in some way, not just in terms of quality, but in terms of perspective.

This is a big focus for us at Michel: giving people something delicious that they cannot get anywhere else so they will remember it and hopefully come back for more of.”

It sounds like you aren’t making desserts, you’re making experiences.

“Yes. I am trying to make something that will make people feel good. As I said earlier, it’s not just taste. That is a big part of French culture that I’ve kept with me. In France you don’t rush cooking or eating. You don’t mind spending a lot of time cooking something that is really good. Eating good food especially with family and friends is a big part of my culture.”

And now you’re sharing that with the US.

“Yes. The restaurant industry has changed a lot in the last ten years. Before then, restaurants served either traditional food at a moderate price or very fancy food that was very expensive. But today you find that food and cooking are more celebrated in the US. People no longer go out just to eat all the time. More and more they go out to have something good. So the spectrum has become much wider allowing for many new perspectives.”

Has the recession changed this at all?

“A little bit. In the last few years, people went out more to celebrate things like a birthday or an anniversary than just to eat dinner. But if you focus on quality and offer something unique and memorable, people will come to eat at your restaurant even if they eat out less.”

So the economy makes them more selective.

“Exactly. That’s why I try to be creative with my desserts at Michel. People are now more careful about how they spend their money. So I have to really create something great that they will remember and want more of.”

This is the future of restaurants as you put it.

“Yes. People will pay for quality. But you cannot just charge any price. If you charge like $40 for a dessert, even if it’s an amazing dessert, people think to themselves, “That was good, but was it $40 good?” Price is not that flexible. So you need to create something of quality, that is memorable, and doesn’t cost too much. You don’t want the person to feel anything other than good at the end of the meal.”

That’s exactly what I thought when I ate the “chicken.” I only remember that it was amazing and how fun it looked. To be honest I didn’t even remember what it cost.

“Then I’ve done my job well.”

You know it’s interesting… without saying it explicitly, you’ve touched on three of the most important attributes of any businessman or entrepreneur. They are 1) to master a talent or skill. 2) Use that talent to create or offer something people value 3) Figure out the “sweet” spot for pricing.

“That is exactly how restaurants work, at least the ones that will succeed going forward. Chefs will have to be creative and original. They will have to create an experience that is memorable. That is what I try to do every day in the kitchen.”

Thanks for the thoughts Mark. We wish you and the rest of the folks at Michel great success.

“Thank you.”

My advice to readers and investors: do yourself a favor… consider what Mark is saying from the perspective of your own business or work. How can you do things in a way that will make people remember you and your work? What kind of experience are you making or selling with your product or service? And if you’re not selling an experience… why not? How could you create one for your clients?

Finally, to anyone who enjoys fine dining, I highly suggest swinging by Michel in Tyson’s Corner if you’re ever near the DC area. Anything you eat there will be amazing. Just make sure you save room for dessert. Who knows, you may find yourself whipping up a business idea of your own.

At the very least, you’ll have eaten one of the best meals of your life.

You can read more about Michel at:

http://www.michelrichardva.com/

Graham Summers

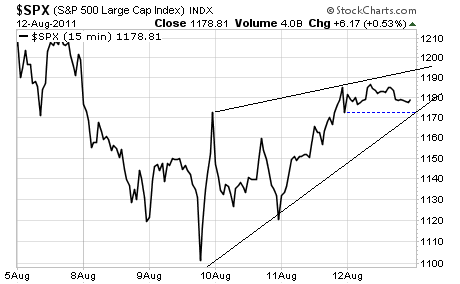

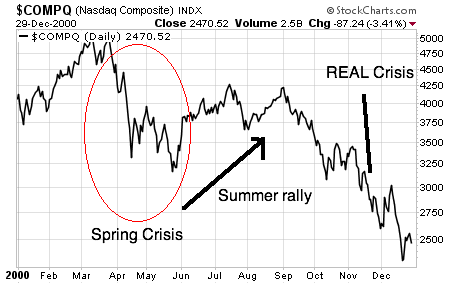

So here we are again… it’s the end of the month, volume is extremely light because of the upcoming weekend… and SURPRISE! Stocks are exploding higher again. In fact, we’re up 9%, quite similar to the 8% rally at the end of June.

So here we are again… it’s the end of the month, volume is extremely light because of the upcoming weekend… and SURPRISE! Stocks are exploding higher again. In fact, we’re up 9%, quite similar to the 8% rally at the end of June.