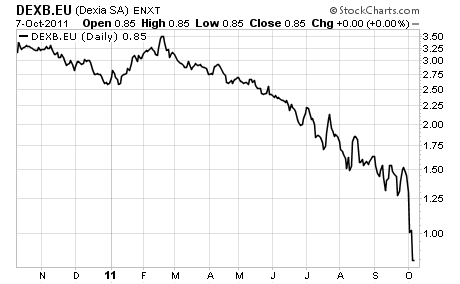

Things are getting truly desperate in Europe. I’d like to show just how bad they are by way of example: the Belgian bank Dexia, which is now in the process of being nationalized.

For starters, Dexia had 566 billion euros in debt and 19 billion euros in equity as of the end of 2010. Right off the bat, that’s a leverage ratio of 29 to 1. Lehman Brothers was leveraged at 30 to 1 when it collapsed.

Now consider that Belgium’s entire GDP is just 348 billion euros. Dexia has 566 billion euros in assets. Of this 352 billion are loans. Put another way, Dexia’s loan portfolio alone is larger than its home country’s entire economy.

AND THIS BANK PASSED THE STRESS TESTS.

Suffice to say, Europe’s banking system is in far FAR worse shape than anyone over there is admitting. The stress tests were complete and total fiction. And the market is starting to figure this out.

Small wonder then that had both the IMF and the Bank of England have recently warned that the world is facing a “financial meltdown” and “the worst financial crisis in history.”

Small wonder then that had both the IMF and the Bank of England have recently warned that the world is facing a “financial meltdown” and “the worst financial crisis in history.”

Ben Bernanke issued his own statement of doom last week as well, stating that his precious recovery is “close to faltering.” For a guy who’s spent TRILLIONS trying to create a recovery to admit things aren’t working out ought to give you an idea of just how bad things will be getting in the near future.

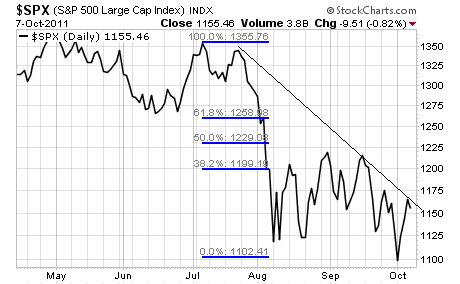

Indeed, stocks were rejected last at a descending trendline from the July top.

We should have at least gotten a bounce to the 38.2% retracement (1,200 on the S&P 500). So if the market fails to get there and simply rolls over here, then we’re going DOWN in a big way FAST.

Here is the reality of the financial system today:

Here is the reality of the financial system today:

- The European banking system is facing systemic collapse.

- The US economy has rolled over and is in a confirmed double dip in the context of a larger DE-pression.

- The Central Banks and regulators have admitted we are peering into the abyss and they have no clue what to do.

Yes, I believe that before this mess ends, the financial system as a whole will have collapsed. What’s coming is going to make 2008 look like a joke.

If you have yet to prepare yourself for what’s coming, now is the time to do so. I can show you how. Indeed, my clients MADE money in 2008, outperforming every mutual fund on the planet as well as 99% of investment legends.

We also outperformed the market by 15% during the Euro Crisis of 2010. And in the last month and a half, while every one else lost their shirts, we’ve locked in 14 winners.

So if you’re looking for a guide to get you through the coming disaster, I’m your man.

I’ve been helping investors, including executives at many of the Fortune 500 companies, navigate their personal portfolios through the markets for years.

I can do the same for you with my Private Wealth Advisory newsletter.

The minute you subscribe to Private Wealth Advisory you’ll be given access to my

Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports telling you precisely which steps to take to prepare your loved ones and your personal finances for what’s coming.

You’ll also join my private client list in receiving my bi-weekly market updates outlining what’s really happening behind the scenes in the markets and which investments will profit in the coming months.

And when it’s time to pull the trigger on a given investment, I’ll send you real-time trade alerts.

All of this is yours for just $199 per year.

In fact, if you subscribe now, you’ll receive my latest issue of Private Wealth Advisory detailing 12 investments that are poised to produce enormous profits in the next month.

The time for dilly dallying is over. The market’s have already taken out critical support and my Crash indicator is on a confirmed SELL. Failing to take action now means risking HUGE losses as the Great Collapse snowballs.

To take action to protect yourself… and insure that the coming weeks and months are a time of profit and safety, NOT losses and pain…

Best Regards

Graham Summers